Cryptocurrency bears are dreaded across the market due to the massive losses that investors can make within a very short time. However, as some traders count their losses during price dips, some are counting profits.

Bitcoin makes for one of the best cryptocurrencies for short selling. Its volatile price movements give agile traders a chance to profit during positive and negative price swings. Read on for more details if you want to learn how to short Bitcoin during a bear market.

What does shorting mean in crypto?

The concept of shorting is quite different from what most traders in the market do, which is to buy at low prices and sell at high prices. When it comes to short selling, the opposite applies. Depending on the platform you are using, you will find all the details you need to know about short selling.

To enter into a short position, you have to borrow cryptocurrencies and trade them on an exchange platform at their current prices. You will have to repay back the capital you borrowed to make your trade; hence you have to buy the cryptocurrency at a future date.

If the repayment date is arrived at and the prices have dropped from what you sold the asset at, you will have made a profit.

For example, assume you short one Bitcoin at $40,000. A few days after you borrow and sell the one BTC at $40,000, the price drops to $35,000. You will now buy one Bitcoin at $35,000 and repay the borrowed capital, leaving you with a $5000 profit.

Why you should short sell Bitcoin

As a trader, you may decide to short sell Bitcoin for a wide range of reasons. Short-selling can be very lucrative, especially when you expect that prices will fall due to external factors that drive the market. Remember you can do this on the Noble Trade Hubs platform.

Below are some of the reasons why many traders prefer short selling Bitcoin:

Valuation

Sometimes the price of Bitcoin can be so overhyped such as it entered the overbought territory. Usually, this happens during strong market bulls when a price bubble is formed as traders flock to the market to take advantage of the high prices.

A trader can use such a trend to profit through short selling Bitcoin. However, short selling is just as risky as normal trading; hence you need to conduct a fundamental analysis of Bitcoin to know the right time to short and the right time to buy back the borrowed coins.

Volatility

Some traders also use the volatile nature of Bitcoin as a reason to short sell. While volatility makes Bitcoin a high-risk asset, it also presents an opportunity for a trader to benefit from the rapid price fluctuations.

A risk-averse trader usually buys low and sells high. On the other hand, a trader with a high-risk appetite will be drawn towards the rewards to be earned when the prices drop. Therefore, if you are well-versed with the market trends, short selling can turn out to be lucrative.

Hedging risk

Bitcoin and cryptocurrencies, in general, are usually ranked as highly-volatile assets due to unexpected price movements. Volatility affects long positions, and traders that have held Bitcoin and expect the prices to fall can use short-selling to hedge against the risk.

If you make a proper analysis and the prices fall according to your prediction, you will profit. These profits can be used to offset the losses you make when your holdings are trapped in the bear market. Using short selling as a hedging strategy lowers the losses made during a bearish market.

What are the risks of short selling crypto?

The cryptocurrency market is volatile in nature as it is still a market in its early stages. While short selling presents a way to hedge against risk, it also comes with risks of its own. Some of the risks associated with short selling Bitcoin include:

Limitless losses

Shorting Bitcoin can enable investors to hedge against risks, but the trade can also expose the investor to limitless losses. When you buy Bitcoin at a lower price, you are exposed to the risk of the price crumbling. However, even with the price dip, you will still be left with the number of coins bought.

If you bought 3 BTC and the market crumbles, you would still have 3 BTC at the end of the day. You can choose to HODL and wait for a price gain that could actually happen sooner than later, and you will be back to making profits.

However, with short selling, you do not actually own the token because you borrowed it, making your losses limited. The losses you make with short selling will surpass your initial investment. If the price of Bitcoin keeps appreciating, the only alternative you have to minimize the losses is to buy back at a higher price.

Margin interest

In short selling, you are borrowing Bitcoin from a broker. The broker benefits from the transaction by charging you interest. As long as you hold the borrowed coins, they will be earning interest.

Suppose that the price of Bitcoin fails to fall per your prediction. You might be forced to hold on to the coins for a little longer with the hope that the price will drop to your targeted price. If you hold for too long, you will be exposed to an increased risk of the interest rates being too high, and they can end up depleting your profits.

How to short Bitcoin

There are many ways that you can short Bitcoin. Before you settle on the best strategy that works for you, ensure that you understand the market trends and consider factors such as regulations in the country where you are based.

You can short Bitcoin in the following ways:

Margin trading

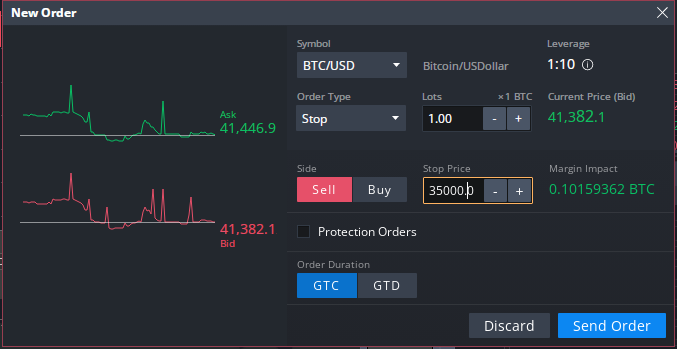

If you are a beginner trader in short selling, margin trading should stand as one of the options that you should most definitely consider. Moreover, it is readily available on some leading exchange platforms including Noble Trade Hubs. Below is how the order page for a margin trade will look like:

With margin trading, you borrow Bitcoin from a broker, and you can use the borrowed amount to execute a trade. Borrowing through margin trading is similar to borrowing money from a bank, as you will have to pay back with interest.

Due to the concept of borrowing, you should consider that you are exposed to limitless losses. When you enter into a contract with the broker, you will have a number of days after which you need to repay the borrowed amount.

When you are repaying back the money owed to the broker, you will have to include the interest rates earned. The longer you stay with the money, the higher the interest you will pay.

When looking for an exchange to use for margin trading, ensure it meets your demands. Noble Trade Hubs provides margin trading to investors shorting Bitcoin. It offers a wide range of benefits to both new and expert traders. The benefits include high leverage, which equates to low margin requirements, making it ideal for short selling Bitcoin.

Futures market

The cryptocurrency market has similarities to the stock market. Just like the traditional financial market includes futures trading, Bitcoin and the entire cryptocurrency space does too.

A futures trade involves buying a contract. The contract will have pre-determined terms, such as the date and the price at which an asset will be sold. This contract binds both the buyer and the seller to fulfil their obligations.

You can buy a contract that predicts that the price of an asset will go up or down. When short selling Bitcoin, you buy the contract that bets on the price of Bitcoin being lower in the future.

When the date of fulfilling the obligations is arrived at, you will agree to sell your contract at a lower price. There are many perks to short selling through futures, with the most outstanding being that it allows a new investor to invest a small amount, which allows them to learn.

Prediction markets

The other way of shorting Bitcoin is through the prediction market. The prediction market is nearly similar to the ordinary market, only that in this case, you are betting on the future price movement of Bitcoin.

You have to be more specific about the price drop in the prediction market. You have to indicate the percentage by which the price of Bitcoin will fall. If you find someone willing to bet against you, you will get returns if your prediction is realized.

The best thing about short selling through the prediction market is that you do not have to borrow money from anyone; hence you will not be incurring additional interest during your trade. If your prediction comes true, you will realize your profits and take home what you have made.

Short selling Bitcoin assets

This is the most straightforward way of short selling Bitcoin. This is the strategy that most short sellers, both new and experts, use to bet on the future drop in Bitcoin prices.

Direct short selling is simple. You can borrow Bitcoin from an exchange at a specified price and then sell it later. You will be required to repay the borrowed Bitcoin back to the exchange once you have sold it.

After borrowing Bitcoin, you hold it as you wait for the value to decline. Once the price dips, buy Bitcoin and then reimburse the exchange. Your profit will be the difference between the borrowed amount and the sold amount.

Using Bitcoin CFDs

The other popular way to short Bitcoin is contracts for difference (CFD). CFDs function like leverage trading, where a broker will allow you to bet on the price movement of Bitcoin without actually owning Bitcoin. This lowers the risk of holding an asset whose value is highly volatile.

To trade Bitcoin CFDs, you are required to deposit a section of the funds on your margin account. This will act as a guarantee that you can buy the cryptocurrency at the price you are placing your bet on.

The amount deposited will be maintained in your account. However, it will be held as collateral by the exchange or the broker lending the Bitcoin to you. To short sell with a CFD, you need to supply a specific portion of the total value of your trade.

After opening your position, you will have a chance to multiply your investment by achieving a high return on investment (ROI). If the price of Bitcoin moves according to the direction you have bet on, your profits will be significant. However, if the price moves in the opposite direction, you will be in the loss zone.

Using inverse exchange-traded products

The other way of shorting Bitcoin is by using inverse exchange-traded products. These are bets made to predict that an underlying asset’s value will decline.

Inverse ETFs are similar to futures contracts. To generate returns, these products can be used together with other derivatives. There are several platforms that can allow you to bet on a BTC dip through ETFs. Examples of these products are the 21Shares Short Bitcoin ETP and the BetaPro Bitcoin Inverse ETF, but it is unavailable to US residents.

What to consider when shorting Bitcoin

Now that you know the different ways you can short Bitcoin and the risks associated with this process, you need to analyze several factors before you jump in. Some of the factors that you need to consider when shorting Bitcoin include the following:

Bitcoin’s price is volatile

If you are already an investor in crypto, then you are well-versed in the volatility of Bitcoin and all the other cryptocurrencies in the market. The volatility of Bitcoin presents a risk in both spot trading and short selling.

The entire concept of short selling is based on derivatives. The derivatives contracts will be created depending on the price of Bitcoin. Bitcoin’s price movement can carry either gains or losses for an investor.

When you invest in Bitcoin futures, for example, the value of your futures contract will be dependent upon the price of Bitcoin in the spot market. Therefore, even with a futures contract, you will not be entirely shielding yourself from the market volatility, as you will still bear losses if the prices shift unexpectedly in the opposite direction.

The same applies to options trading. Your losses when shorting Bitcoin through options trading will multiply because of the volatility of Bitcoin as the underlying asset.

Bitcoin, as an asset, is risky

The risky nature of Bitcoin does not solely lie in its price. Bitcoin is still a new asset. It was created in 2008, and it has only started receiving attention recently. The history of Bitcoin is still short, and there is not much information that can allow an investor to make an informed decision.

One of the factors that can be used to assess the feasibility of Bitcoin is any issues that may have been identified on any of the Bitcoin forks available in the market. Moreover, blockchain technology is still fairly new and is susceptible to hacking attacks.

Over the past few months, there have been several hacks on projects running on blockchain technology, and while the Bitcoin network has not been directly impacted by the hacks, the threat is still there.

With stock markets, the risk of trading futures contracts solely lies on the price moving in the direction you have not expected it to move, making it a less risker product than short selling Bitcoin.

The regulatory status for Bitcoin is still unclear

There are many limitations to Bitcoin being a new asset class. The other limitation is that regulators are yet to wrap themselves around the concept of cryptocurrencies. Moreover, the cryptocurrency sector advertises itself as being decentralized, resulting in the lack of a unified regulatory framework globally.

The regulatory dilemma has made some of the popular cryptocurrency exchange platforms unavailable in some countries, such as the US. Moreover, some exchanges have been releasing products that have yet to pass due diligence in the hands of regulators.

The lack of regulations or the general confusion on how to regulate Bitcoin increases the risk of an investor who invests in a product that has not been otherwise approved. Short selling Bitcoin is risky, but it can become dangerous in an unregulated market.

Knowledge of order types is a must

Last but not least, you also need to consider how informed you are about the concepts of short selling Bitcoin. Like in the traditional market, crypto exchanges will also allow you to choose the kind of order you want to create.

If you are a cautious trader, you might want to choose an order type that will enable you to limit losses. The best thing about selecting an order type is that your order will be automatically fulfilled after the price reaches a specified level.

For example, the stop-limit order, which is one of the most popular order types, allows you to trade derivatives in a way that will limit your losses. It allows you to choose the risk you are willing to take by your investment.

Below is an order page for a stop-loss order on Noble Trade Hubs:

Tips for shorting Bitcoin

If you are just new to short-selling or the futures market, you need all the information you can get on the best way to get started. You do not want to go in blindly, considering that the Bitcoin market is already risky on its own. Below are some tips to help you get started:

Use technical analysis

Using technical analysis includes adopting real-world data to make market predictions. The data used to conduct this analysis includes the historical performance of an asset. For example, if you are analyzing Bitcoin, you can look at the current trading volumes and compare that to future volumes.

Technical analysis is based on the theory that history will repeat itself in terms of prices and the market trend. This past information can then be used to make informed decisions about the future.

Moreover, crypto analysts argue that price movements are not random, but they rely upon a trend. The trend can be either short-term or long-term. Most of the time, the price of Bitcoin will reverse after it has followed one trend for a long time.

The most common indicators used in the technical analysis of cryptocurrencies, all of which are available on the Noble Trade Hubs platform, include:

- Relative Strength Index (RSI) – This indicator shows the magnitude of the price change and the behaviour of traders: whether they are buying or selling

- Bollinger Bands – they show whether the price of the crypto is too high or too low

- Average Directional Index (ADX) – used to determine the strength of the market trend

- Standard deviation – used to assess the historical validity of an investment into Bitcoin

For more accurate results, you can combine these indicators with other statistical tools such as moving averages (Mas), Fibonacci ratios and extensions, the volume-weighted average price (VWAP) and the time-weighted average price (TWAP).

Moving averages are the most common as they are used to analyze the price of Bitcoin over a given period. For a more accurate prediction, you can combine all the moving averages.

Below is a chart from Noble Trade Hubs showing various metrics such as the moving average convergence divergence (MACD). MACD shows the relationship between two moving averages.

These statistical concepts can be hard to understand, especially for a beginner trader. Be patient in learning all the technicalities involved because this will allow you to make a smart decision when short selling Bitcoin.

Keep up to date with the news

The crypto market is very eventful, so keep up with what is happening within the market. It is crucial to consider external news in the political and economic sphere. News regarding government regulations usually sends the market into turmoil.

If there is an expected government crackdown, use the opportunity to short Bitcoin. However, ensure that the trade you are making will not land you in trouble with regulators.

Short crypto during rallies

One of the best times to short crypto is during market rallies. When the bullish sentiment is strong, traders start buying out of the fear of missing out (FOMO), resulting in the token being overbought.

However, such rallies do not usually last for very long. The hype will eventually die down, the uptrend will be exhausted, and a price correction will follow shortly after. This gives you a chance to make returns.

Use fundamental analysis

You can still conduct fundamental analysis on Bitcoin despite the market being new. The fundamental analysis increases the chances that you are making an informed decision.

When conducting this analysis, look at the factors that influence the demand and supply of Bitcoin. In this case, some things to consider include market sentiment, news, level of adoption, and market activity.

Fundamental analysis will allow you to determine the intrinsic value of Bitcoin. Looking at different factors can help you determine whether the price of Bitcoin is overvalued or undervalued.

On-chain metrics

When using fundamental analysis, you can combine it with different metrics, such as on-chain metrics. On-chain metrics are the easiest to use because the data is generated in real-time, and it is readily available on different websites.

Transaction count

The transaction activity will show you what is happening within the Bitcoin network. You can analyze the transaction count metric using moving averages to determine how the transaction activity has changed within a given period.

However, you cannot rely on the transaction count alone to make your decision because it can be unreliable. Sometimes, increased activity on a network could be triggered by the same group of traders transacting between different wallets.

Transaction value

Finally, analyze the transaction value. This metric shows you the number of transactions that have been made during a specified period. For instance, if 100 BTC worth $45000 has been transacted in a day, the transaction value will be $4,500,000.

Transaction value metrics are also readily available on different websites. Websites that provide price analytics will display the total traded volumes within the past 24 hours, allowing you to assess the popularity of the coin in the market.

Conclusion

This comprehensive guide for Noble Trade Hubs traders has provided all the details needed when short selling Bitcoin. Short selling provides you with a way to still generate profits when the market is down or when you expect the market to crash.

When the crypto market is crashing or expected to crash, many investors rush to liquidate their holdings. However, if you become well-versed with short selling, you will be making returns while others are losing.

However, while short selling can appear lucrative, it is still as risky as spot trading. In fact, short selling is even riskier because you are borrowing cryptocurrencies to fulfil your trade. Therefore, if the trade does not go as expected, you will have suffered monetary loss, and you will still not have Bitcoin in your wallet account.

Therefore, short Bitcoin when you have confirmed that the market will crash. The tips listed above will help you conduct an analysis that allows you to make an informed decision. If you are still unsure about short selling after reading this guide, you can consult with an expert on crypto trading.

Why short Bitcoin with Noble Trade Hubs

Noble Trade Hubs ranks as one of the best platforms for shorting Bitcoin. At Noble Trade Hubs, you will enjoy a user-friendly interface, attractive trading fees and a high leverage. Noble Trade Hubs also provides you with several metrics to make your trading experience easier.

Noble Trade Hubs also makes for a very ideal platform for a beginner trader. A copy trading feature will allow you to copy the trading strategies used by expert traders. There are many traders to choose from and tools allowing you to filter through the trading strategies that best match your needs.

Can you short Bitcoin?

It is possible to short Bitcoin just like any other cryptocurrency. To short BTC, you simply have to bet on the price of the primary cryptocurrency declining. Given that the crypto market is highly volatile, it is most likely that the price will fall after a given time. Remember, you can short BTC on XBTPrime.

What is the best way to short Bitcoin?

There are many ways to short Bitcoin. If you are a beginner, the best way to start shorting Bitcoin is through margin trading, where you borrow Bitcoin from a broker and pay later on. Open up the margin page on the Noble Trade Hubs platform and place a sell order.

Is there an ETF to short Bitcoin?

You can short Bitcoin on Noble Trade Hubs through an inverse ETF that will bet that the price of Bitcoin is going to decline. Examples of inverse ETFs include the 21Shares Short Bitcoin ETP and the BetaPro Bitcoin Inverse ETF. However, these products are not regulated in all countries, including the US.

Can I short other cryptocurrencies?

Bitcoin is the primary cryptocurrency and the most popular, meaning that most crypto products will include this asset. However, short selling is open for other cryptocurrencies using the Noble Trade Hubs platform. Just go to the platform and select those cryptos which you believe will drop in price and place a sell order.

Where can I short Bitcoin?

If you want to short Bitcoin, you can do so on a cryptocurrency exchange. However, with products such as inverse ETFs, you need to create an account with the firms offering the products. Therefore, the place where you can short Bitcoin depends on the strategy you are using.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Trade Hubs. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Trade Hubs recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.