After a good start on the first trading day of the year where stocks rallied, the following four days were filled with panic as traders started worrying about interest rates. Cryptocurrencies were the worst of the lot, with Bitcoin sinking deeper into the red as the year kicked off.

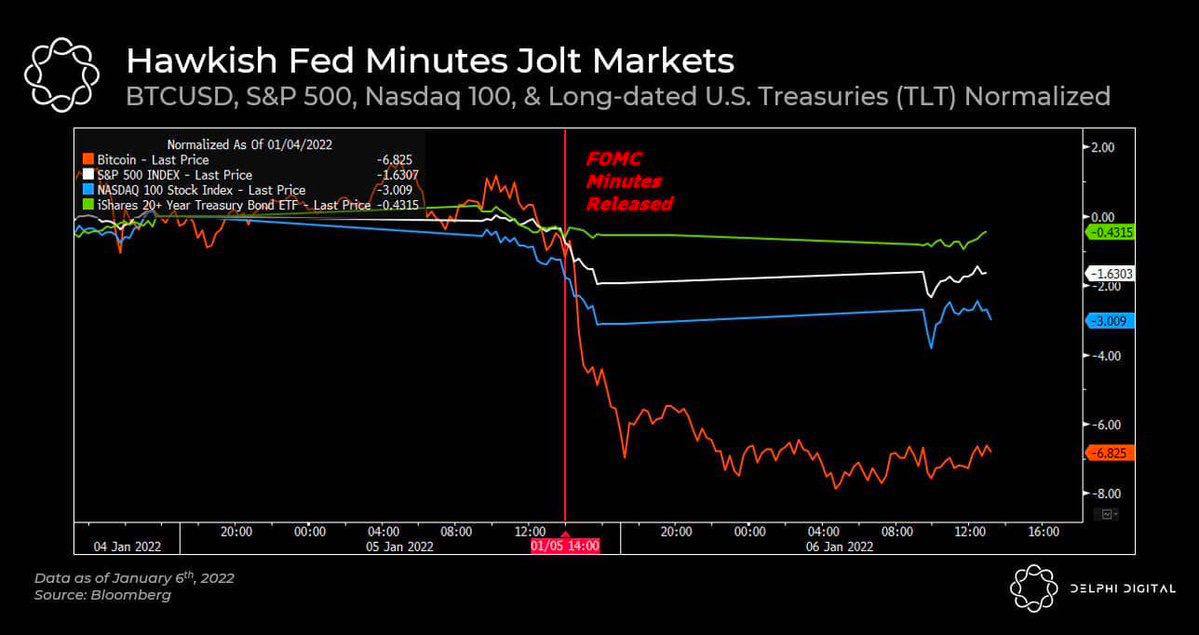

When Wednesday’s FED minutes were released, traders got wind that the central bank is ready to dial back its economic help more rapidly than most had anticipated, including taking steps to shrink its balance sheet while raising interest rates sooner than expected.

With the FED minutes sending out waves of panic, cryptos were hit really hard, dealt a fatal blow that caused Bitcoin to break the level of $45,500 which had been supporting its price for the whole of December.

Upon the release of FED minutes on Wednesday, Bitcoin plunged 6.8% straight to $42,500 as the asset reacted drastically, with the Nasdaq second behind in magnitude, dropping 3%.

All of this has resulted in mass selling of risky assets, with tech stocks especially battered as a rising interest rate environment would dent economic growth.

The tech-heavy Nasdaq posted its worst week since February 2021, down about 4.5% in the first five trading days of 2022. The S&P 500 was off by 1.8%, while the Dow lost only 0.29% as investors rotated into some value stocks amid the rise in rates. Banking and financial stocks which would do better in a rising rate environment were bid, while energy stocks also rose due to the rise in oil price.

The 10-year Treasury yield topped 1.8% by Friday on the abrupt rise in interest rate expectation, a big increase from the 2021 year-end level of just 1.51%.

Before traders could fully digest the latest FED minutes, Friday’s worse than expected jobs report sent further chill to the markets. The Labor Department reported the US economy added far fewer jobs in December than expected. The nonfarm payrolls report showed an increase of only 199,000 in December, versus market expectation of 422,000.

With FED tightening on the way while the labor market is showing a mixed picture, the markets continued selling into Friday, and may show volatility this week as investors rotate out of highly valued tech names into value stocks, or could even leave the market entirely.

Precious metals also succumbed to the weight of the FED, as rising interest rates would make holding cash more attractive than holding precious metals which gives no yield. Gold fell 1.9% back below $1,800, while Silver felt the double whammy of both being inversely related to interest rates as well as being an industrial metal which will see reduced demand in the event of an economic slowdown. Silver fell 4.3% to $22.40 by the end of last week.

Oil however, was not affected by the risky asset selloff, and started 2022 with a bang. The much-anticipated OPEC+ meeting on Tuesday disappointed the market by not increasing supply in the amount that the market had hoped. Further to that, political unrest in Kazakhstan mid-week was affecting oil outputs from Kazakhstan and Libya rather drastically, as several large oil companies noted that supply from the region fell around 30%. As a result, Oil became the only asset that rocketed into 2022, gaining more than 5% in the first week of trading.

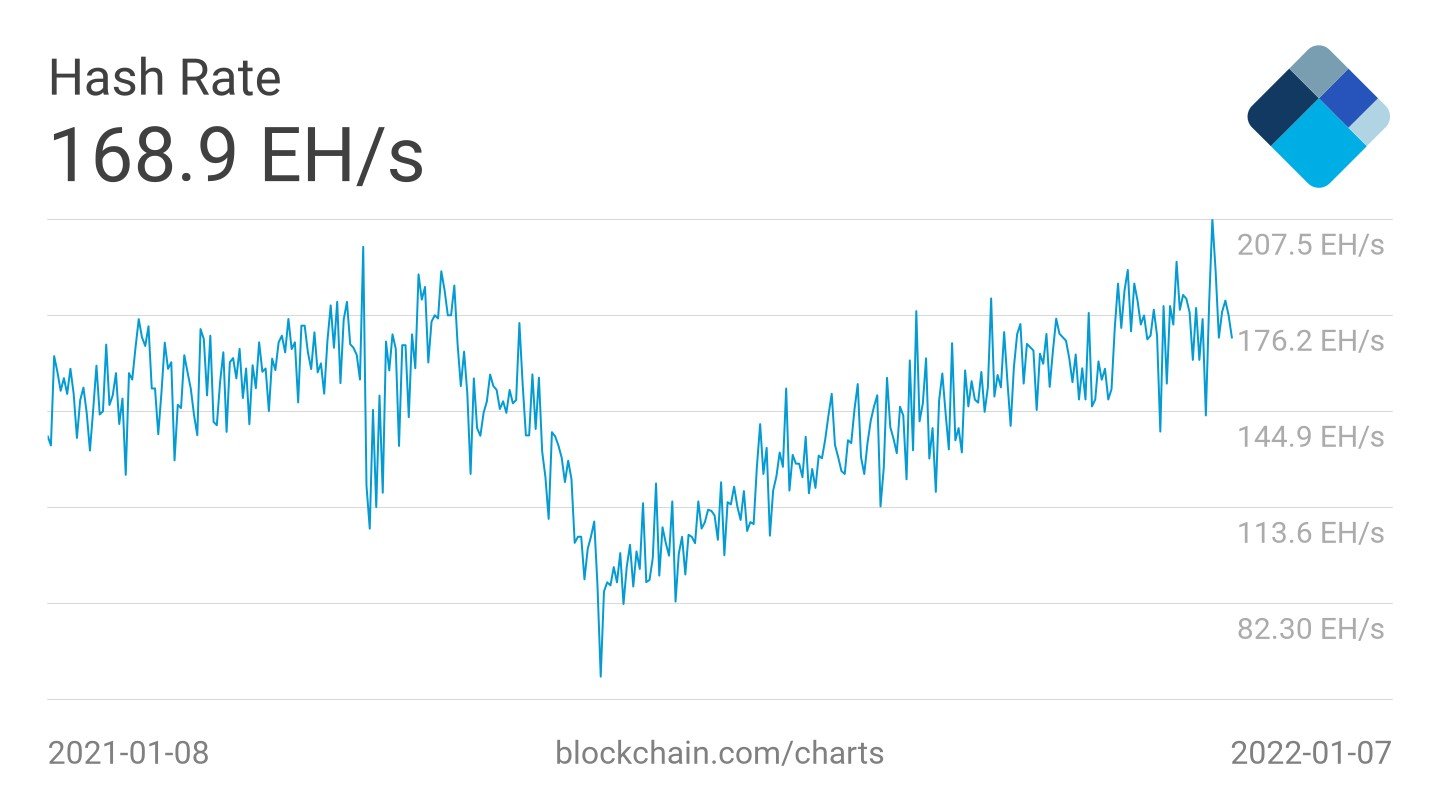

Kazakhstan Internet Cut Crashes BTC Hashrate

Even though FED minutes were the main culprit sending markets down, in the case of BTC, it wasn’t the only negative news that broke the camel’s back.

On Wednesday, Kazakhstan, the second-largest country in the world currently when it comes to BTC mining hash rate, experienced unprecedented political unrest due to a sharp rise in fuel prices. As a result, the country’s presiding cabinet resigned, but not before the state-owned Kazakh telecom shut down the nation’s internet, causing network activity to plunge to 2% of daily heights.

The move dealt a severe blow to BTC mining activity in the country. As per data, the BTC network’s overall hash rate declined 13.4% in the hours after the shutdown from about 208,000 petahash per second (PH/s) to 168,900 PH/s. Kazakhstan has been accounting for 18% of the BTC network’s hash activity since last August after many miners from China moved there due to the China mining ban.

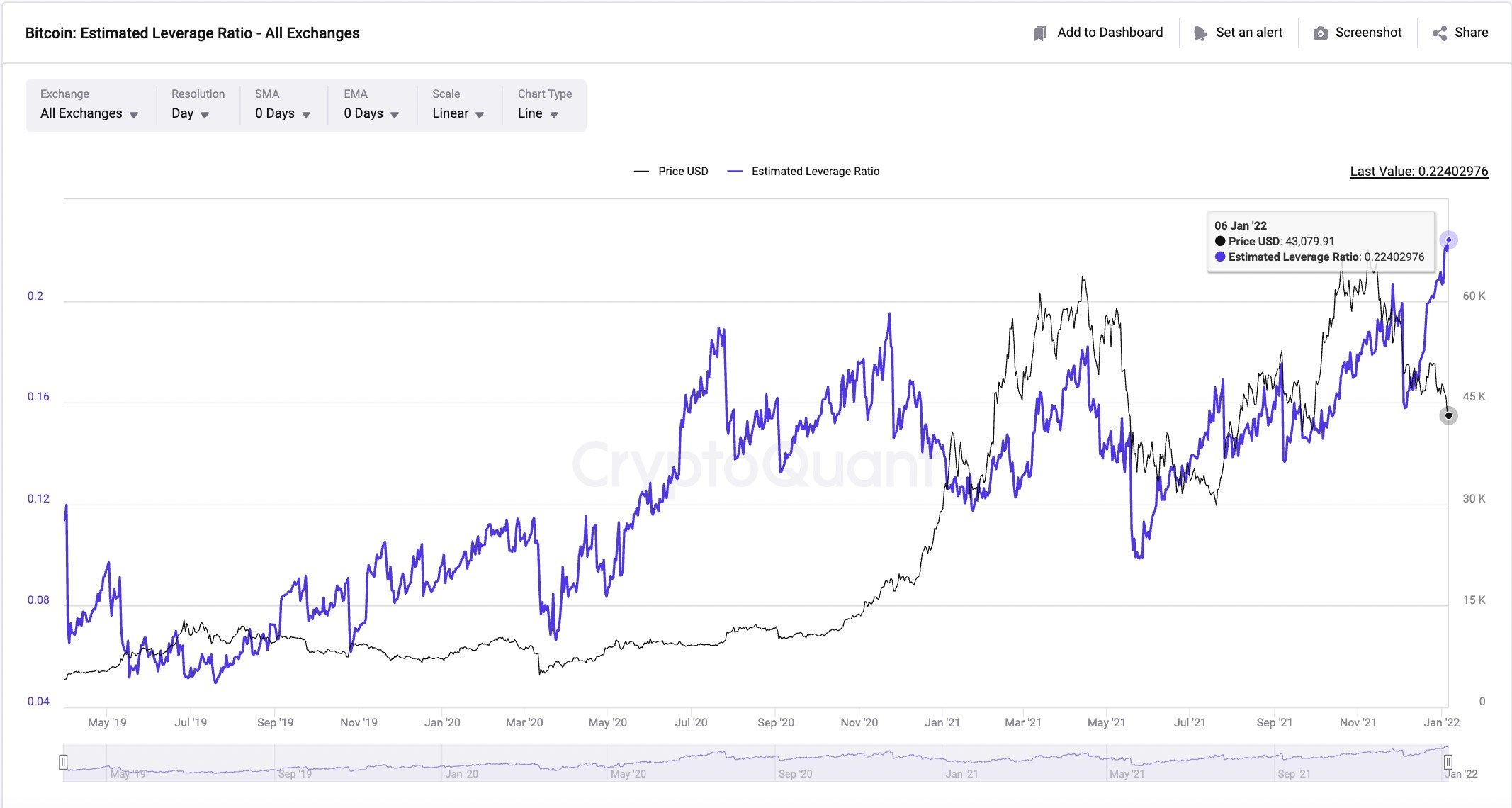

Metrics Still Reveal High Leverage Despite Price Dip

While the headlines look bad and the price is falling, the number of liquidations is nowhere near the past figures in the region of billions of dollars.

Within 24 hours of the Wednesday plunge, crypto futures amounting to only over $812 million were liquidated, with 87% of them being long positions.

The total amount of Open Interest only fell 8% following the move, implying that many traders have not been wiped out and were still holding leveraged positions.

On top of this, the funding rate is still at a high positive, meaning traders could be still adding leverage positions to continue buying the dip.

This has caused the leverage ratio to surge higher, making an ATH of 0.224. A leverage ratio of less than 0.1 usually indicates good buying opportunity, while a figure above 0.2 indicates excess leverage in the market. Historically, leverage ratio falls as price falls, while in the current situation, an increasing leverage ratio when the price of BTC is falling makes for an unusual situation fit for the history books.

BTC Dominance Breaks One Year Low

The aggressive adding of leverage could be due to traders having a more optimistic outlook despite the fall in BTC’s price. This sense of hope could be attributed to some altcoins not being nearly as badly affected as BTC in the rout.

Some altcoins were able to rebound quickly from the selloff, eg. ATOM even managed to hit an ATH of $44.65 on Friday before pulling back, while BTC continues to get bruised by the rising interest rate narrative. This shows that good altcoins that have their own unique use cases could do well this year as BTC loses favour as an inflation hedge.

This was already clearly in play at the beginning of the week when altcoins like NEAR, FTM and ONE enjoyed good double digit rises at the onset of the new trading week on the back of new project partnerships. Even though these tokens also retraced during the selloff, they managed to recover most of their losses, while BTC is still trying to find its footing.

As such, with some altcoins enjoying far better days than the leading crypto, BTC dominance has broken a one-year low, looking poised to continue dipping as BTC continues to consolidate, giving altcoins an opportunity to shine.

With BTC Dominance having broken down from the previous 2021 low, the next area of support is some distance away at 36.35%, which was the 2018 low. This could imply that there is a lot more room for altcoins to overshadow BTC as it comes under direct pressure from the FED’s monetary policy tightening.

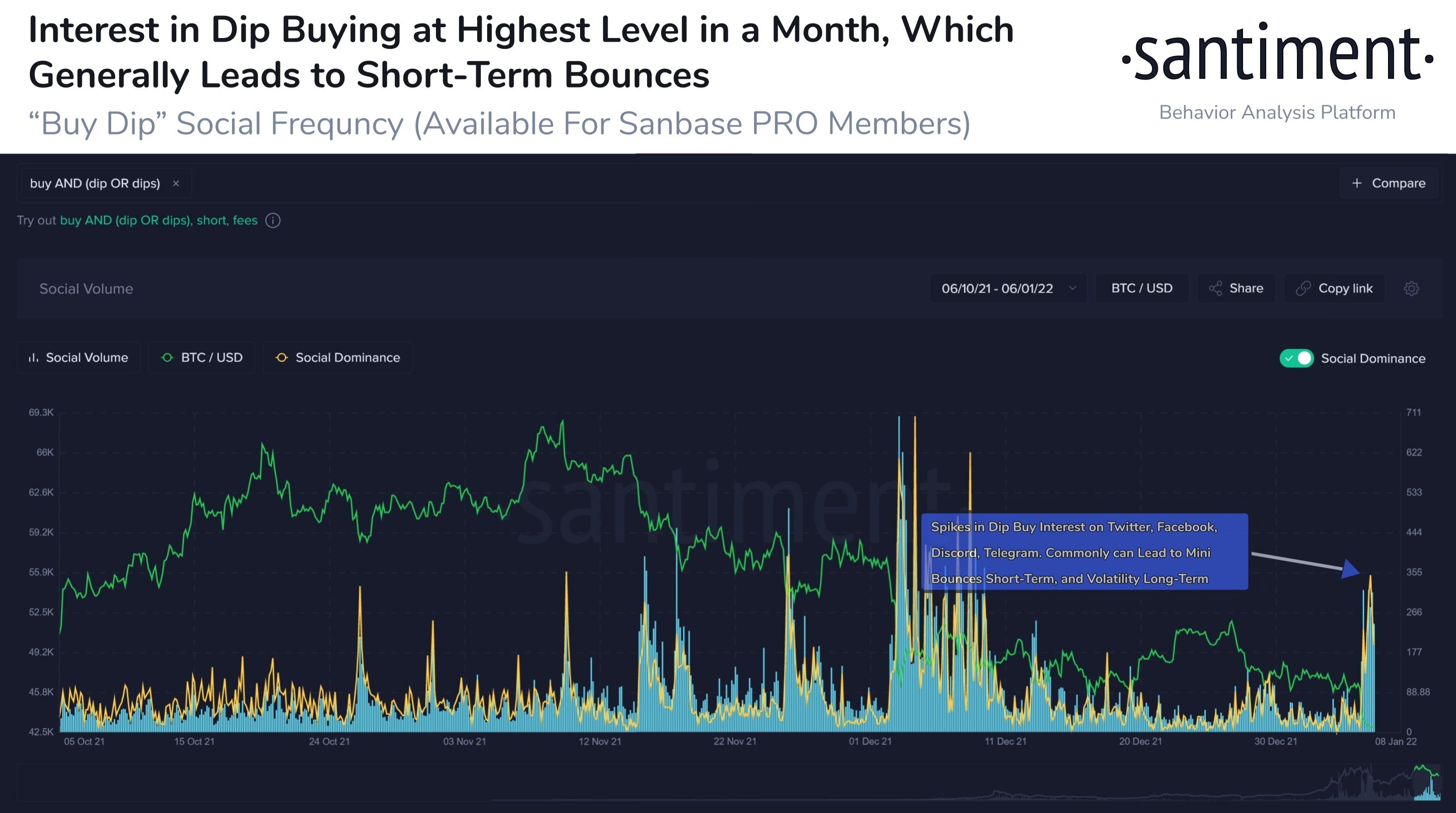

Dip Buying The Name of The Game

Even though the current narrative is negative for BTC, it still has plenty of die-hard fans who continue to accumulate despite the seemingly bearish indicators, examples being the third largest BTC wallet and Binance.

The third largest whale started buying more BTC to kick start the year, adding another 456 BTC at $46,300 to kick start the year on 3rd Jan, and subsequently buying another 551 BTC during the Wednesday dip. The wallet continues to aggressively accumulate, now owning a total of 121,396 BTC.

A Binance whale wallet also added 43,000 BTC to its reserves on Tuesday, even though he could have gotten it cheaper had he waited just one more day. This wallet has accumulated a whopping 116,601 BTC and has never sold a single Satoshi.

Meanwhile, Justin Sun, the founder of Tron who, in the week before, sold his ETH holdings, took to twitter to exclaim that dips like this are the best time to buy. Sun also said that he was going to buy 100 BTC, but has not disclosed if he had really bought the 100 BTC yet.

Indeed, a check on social sentiment shows that social media interest keywords related to dip buying is at its highest level in a month, which could explain why the leverage ratio is still at a high level despite a relatively large market dip by recent standards – certain groups of traders are aggressively buying on leverage in the hope for a rebound.

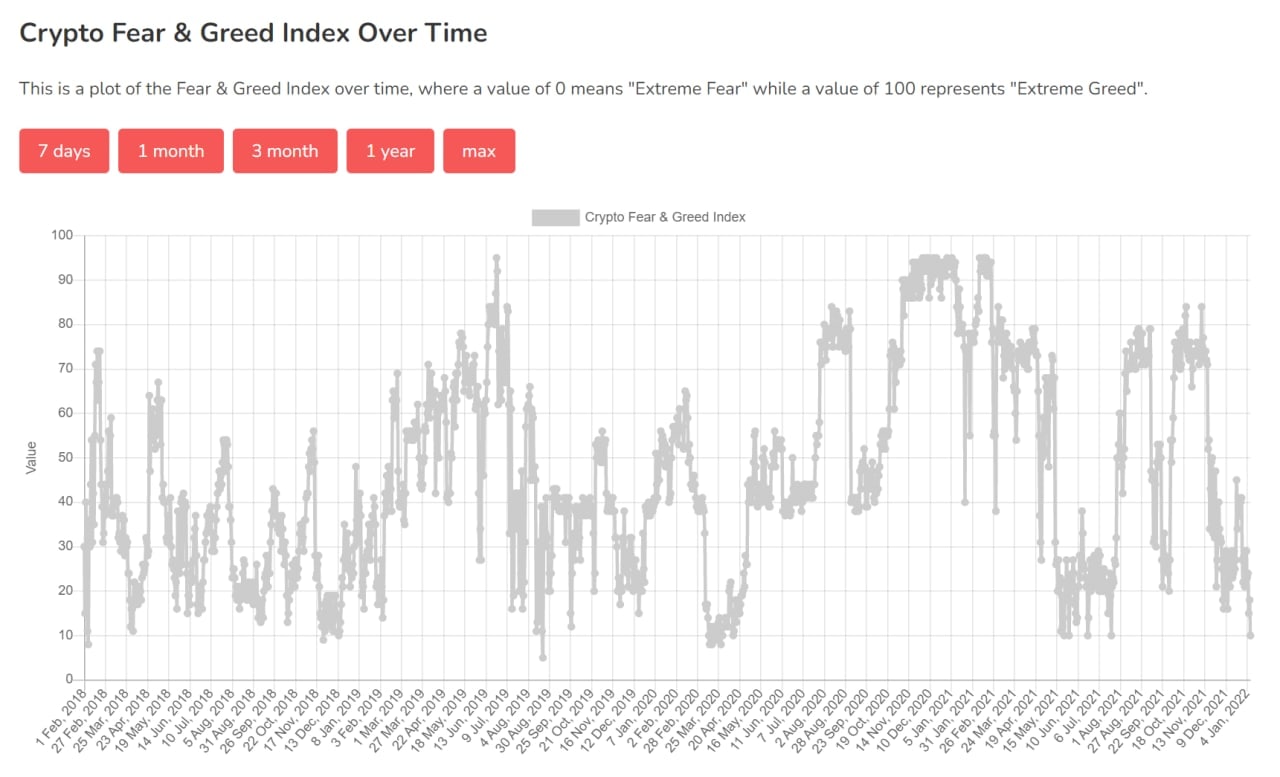

While some traders are aggressively buying, this group of traders does not seem to be the norm, which may then mean that the odds could be in their favour. One way to determine crowd sentiment is to look at the Greed and Fear index, which measures the overwhelming sentiment amongst market players.

The index has fallen into the Extreme Fear category with a reading of 10, which is the lowest point since July of last year. The reading of 10 is also just inches away from the reading of 8, which was the low point made during the COVID-induced big selloff in March 2020. When the reading hit this level in the past, the market often rebounded.

While swinging into a raging bull market may not be likely in the near-term, the chance of a technical rebound is there when the market gets more and more oversold.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Trade Hubs. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Trade Hubs recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.