There was a touch of traditional markets meeting cryptocurrency markets as Coinbase became the first cryptocurrency exchange to go public. This was huge news in the growth and acceptance of Bitcoin, but unfortunately, it was not enough to stop a bit of late bloodshed in the markets.

Bitcoin has erased a lot of the gains it managed to pick up in the week after it broke a new all-time high of over $64,000. It has since slumped to a weekly low of $53,000. However, eyes were not fully on Bitcoin as another coin also reached an impressive all-time high — Doge. The meme coin saw 500% gains in just three days.

Elsewhere, the stock market has also been rallying as all three major indices managed to break another all-time high after a sip in treasury yields. With this boost for the stock market, the USD was down which in turn helped strengthen other currencies.

A Week Of Big Moves

It was a highly anticipated week as all market participants look forward to Coinbase’s listing on 14 April. Crypto market was on fire, likewise, the traditional market which saw the Nasdaq break ATH by Tuesday, ahead of Coinbase eagerly awaiting listing.

A “higher-than-expected, but not high enough to invoke fear” inflation number released mid-week set the balling rolling, with a strong retail sales number further adding to positive sentiment. A sudden dip in Treasury Yields added fuel to fire, sending stocks carving out yet another ATH for all 3 major indices.

US Treasury yields registered their biggest one-day decline since early November on Thursday, with the benchmark 10-year yield closing the week at around 1.58%, compared with 1.63% the week before. The Dow closed at 34,179, S&P 4,181, and Nasdaq has finally broken its previous ATH to close above it at 14,040.

USD retreated as a result, with the DXY closing the week at 91.50, lending strength to all other currencies. EURUSD and GBPUSD advanced around 1% on the week, with even the weak AUDUSD advancing. However, DXY is beginning the new week a tad stronger at 91.65.

Gold and Silver rebounded strongly, with Gold bouncing off from the double-bottom breakout to $1,782 and Silver back above $26. Better times are expected of commodity prices due to inflation as the USA and China reopen and boost consumption to help their economies. Oil also rebounded, closing the week at $63.20 after bouncing off the $60 support.

BTC Breaks ATH On Coinbase Listing Hype But Could Not Sustain Price

As if buying 100,000 BTC is not a loud enough endorsement, the board of directors of MicroStrategy will now be paid their fees in BTC. However, the BTC will not be from their current stash, but the firm will use fiat currency to purchase BTC to pay their directors every month.

Other endorsements came from various personalities like Robert Kiyosaki, who bought BTC at $9,000, has come out to publicly endorse BTC, predicting that it will be worth $1.2m per coin in 5 years. Time magazine is also dropping a series of educational videos to educate noobs about cryptocurrencies and has agreed to be paid in BTC.

The hype over Coinbase listing sent the price of BTC soaring above $64,000 before a lackluster performance of Coinbase’s first day of trading sent some traders to take profit. News that 12,208 BTC, worth around $750m from a 2016 hack of a crypto exchange further put a dent on the price of BTC as traders worried that these 12,208 BTC would be sold in the market.

Traders might be unduly worried as 12,000 BTC could be easily absorbed by Coinbase buyers who have been buying and withdrawing 12,000 BTC several times in the past weeks. This is especially true on the back of more good news entering the space, with the confirmation of Gary Gensler, who is pro-crypto and popular amongst the crypto community, as the new SEC Chairman.

BTC And Crypto Market Plummets On Regulation Fear

Two regulation-related events caused BTC to plummet from gains two times over. First was a cryptocurrency ban by Turkey. Turkey has been plagued by a rapidly depreciating currency for ages and has moved to ban the use of cryptocurrencies as payment amid its own currency crisis. While Turkey’s share of the crypto market is small, it may set a bad precedent for other countries to follow.

Morocco has also enacted such a ban. This fear caused the broad crypto market to sell off rather sharply by today’s bull market standard, with BTC falling around 3% with the first 24 hours of the news.

Next comes the big event. What caused a big crash in prices is a rumor that the U.S. Treasury Department may soon accuse a number of financial institutions of using cryptocurrencies to launder money.

This news, coming on the back of warnings by financial experts of impending government restrictions or ban on cryptocurrencies, cannot come at a worse time, especially when BTC has been lacking momentum above $60,000. BTC price crashed from $60,000 to $50,000, or around 17%, while the broad altcoins bled between 15-35%.

The crash liquidated a historical high of over $7b worth of leverage longs within the first hour, and another $4b in the following 6 hours – a testament to how leveraged the market has become. A total of $10b worth of leverage longs had been liquidated, with the total market cap of all cryptocurrencies dropping around $360b in hours back to $2.05 trillion.

As the new week begins, the crypto market is beginning to rebound from the selloff, with BTC near $57,000 having bounced off a selloff low of $50,000.

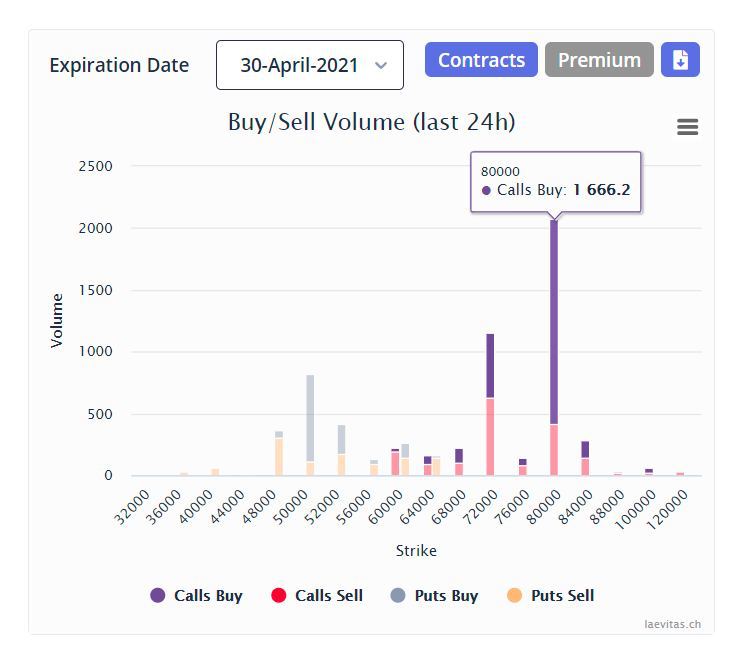

Before the rumor that set off the fire sale though, Friday saw the sudden spike of 30 April expiry BTC call options with a strike price of $80,000. Open interest in the 80K strike BTC call option continued to grow and over 1,600 such contracts had been bought.

While this may not necessarily mean that BTC will rise above $80,000 by 30 April, the sudden spike in interest is rather alarming given the ongoing weakness in BTC price.

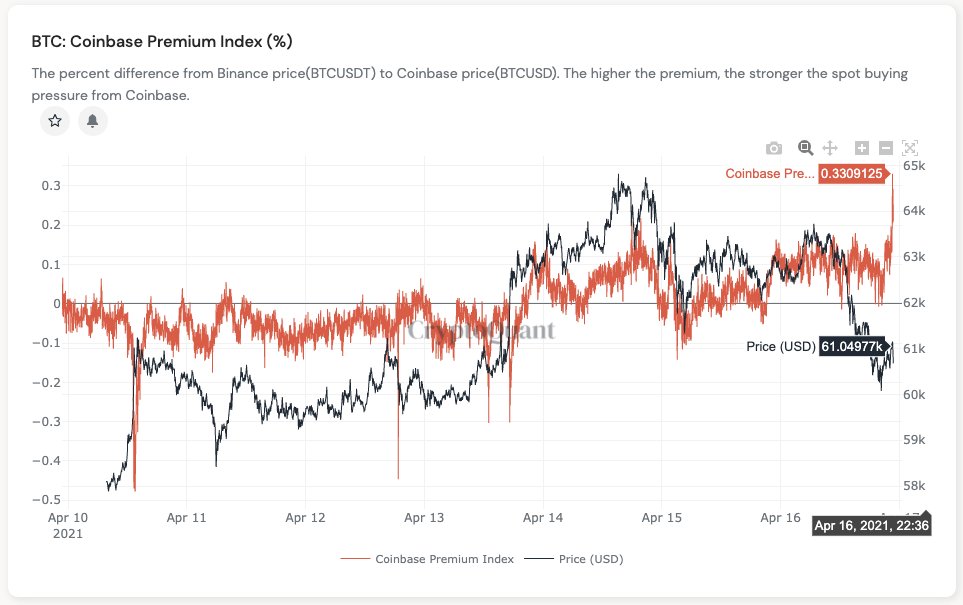

The spike in Open Interest in BTC call option also coincides with a sudden spike in Coinbase Premium, suggesting that buyers from the USA were getting bullish.

This bullishness may be due to BTC hash rate rising yet again, this time, to a record 200 EH/s. Experts in the field have always advocated that price follows hash rate. Hence, this may be one reason why despite some uncertainty surrounding crypto regulations, BTC buyers still expect prices to go up.

However, into the weekend, the hash rate surprisingly crashed to 129 EH/s just before the market crash on Sunday. Experts attribute the sharp drop in hash rate as a result of miners going offline in China due to a power outage instituted by the Chinese government.

The hash rate of several major BTC mining pools has dropped by around 25%. The blackouts were necessitated because of a “comprehensive power outage safety inspection” in Xinjiang, and is a state-wide exercise, not directed at crypto mining facilities.

ETH Derivative Volume Displaces BTC As Interest In Trading ETH Swells

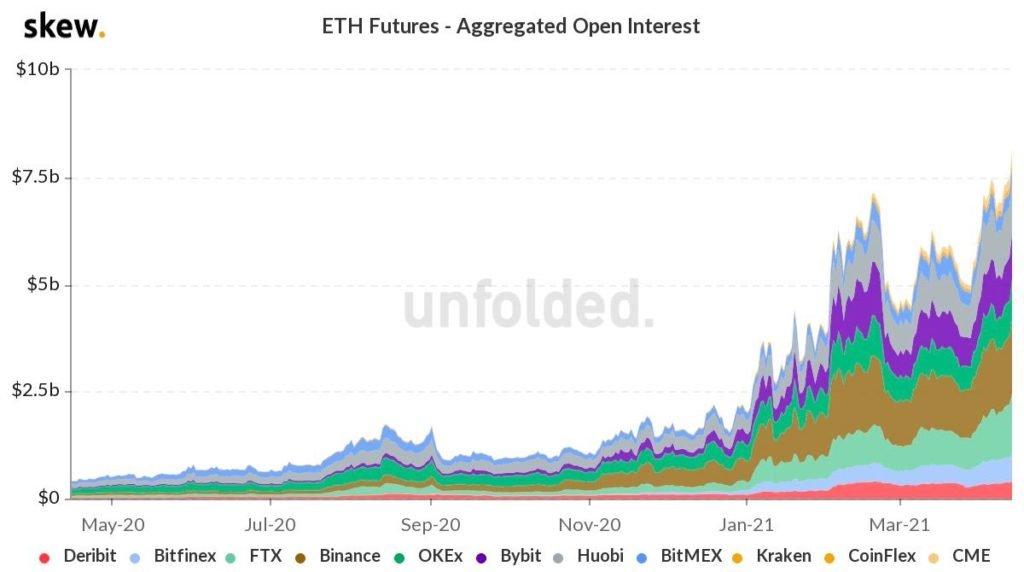

With BTC lacking momentum above $60,000 and a better altcoin market, interest in trading BTC derivative products has also declined this month. The decline, however, is made up for by the increase in trading interest for derivative products on ETH.

Despite record open interest of around $25b, BTC futures volumes appear to have been declining over the past month, sagging from $117b from 15 March to range between $50b and $75b this month, according to data. Volume and open interest in BTC options has declined since a record $6b worth of contracts expired at the end of March.

However, both open interest and volume in ETH futures have been climbing, with open interest surging to record highs above $8b as volumes increased over recent weeks. ETH’s options markets have also seen an increase in activity, with open interest pushing into 30-day highs near $3.2b. ETH options volumes jumped 90%, surging from $200m to $380m.

This suggests that traders are now piling in to trade on ETH with its upcoming upgrades over the next few months, while BTC, having no significant news that could increase volatility, is getting less attention. This could explain the better price action on ETH compared with BTC last week.

Even Rothschild Investment announced a $4.75m initial stake in Grayscale’s ETH Trust. The asset manager disclosed Thursday its shares in the Ethereum trust were worth $4.75 million as of March 31. The interesting fact is that its holdings in the BTC Trust was only $1.92m, which may suggest that Rothschild is a lot more bullish on ETH than on BTC.

Berlin Upgrade To Reduce Fees Sends ETH Past $2,500 Before Breaking Down

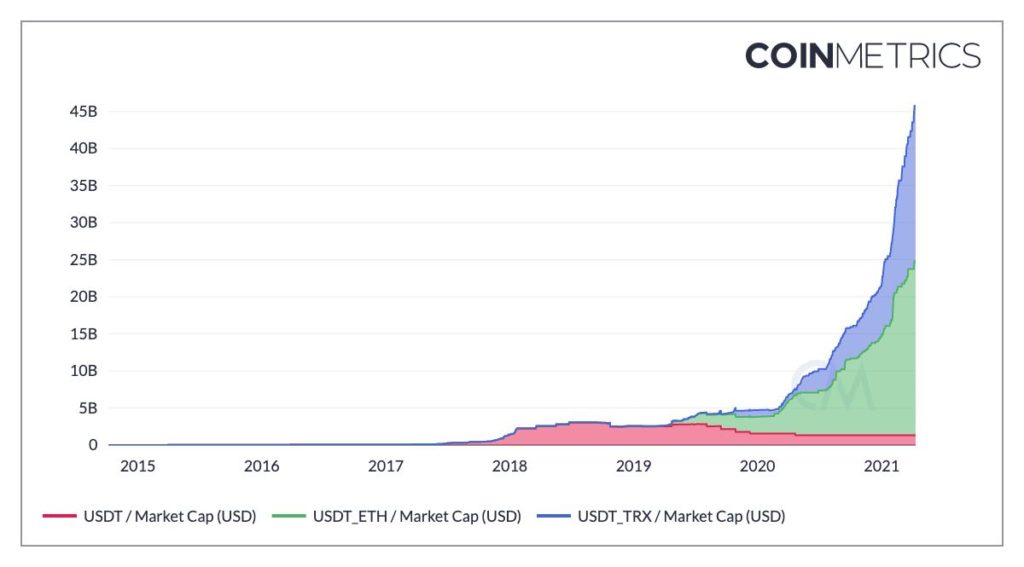

The Berlin upgrade last Wednesday finally sent the price of ETH mustering enough firepower to surge 20%, hitting a high of $2,548. Berlin upgrade will lower the transaction fee of using the ETH blockchain over time and is expected to bring back some users who have gone to other blockchains due to ETH’s high gas fee. For instance, a lot more users are using the Tron network to send USDT as the Tron Network is a lot faster and costs nothing to send.

A lot more newly minted USDT is on the Tron network, with a sharp increase of Tron-based USDT being minted this year. This, coupled with other developments in DeFi and NFT on the Tron network that has greatly increased usage and adoption, has led the TRX token to more than double since the end of March.

As for ETH, with more upgrades like “London” in June and “Optimistic” Rollup as well as EIP 1559 to start in July, a higher price is expected of ETH after it has lagged behind many of its competitors, with BNB the closest contender where price has gone up multiple times.

The MPRV multiple seems to indicate that a lot more upside may be coming for ETH in the coming months. If historical evidence is a good gauge, a similar MVRV ratio run-up like in the past may be ahead for ETH and eventually, a multiple of 5 could be reached by the end of May. This would translate to a price of $4,010 for ETH, a 70% increase from current levels.

With the excitement surrounding Coinbase listing, tokens of other crypto exchanges surged, with BNB continuing to surge, almost doubling from $360 to a high of $638 before retreating to below $500. Native tokens of other crypto exchanges have also surged multiple times this year, but all have since retreated on Sunday.

With the Berlin upgrade supposedly able to lower transaction fees on the ETH blockchain, DeFi project tokens built on ETH also saw some good gains. AAVE, COMP, YFI, BAL, SUSHI, MKR all rose between 10-50%, springing back to life after being quiet for 2 months. They, however, have given up almost half of their gains after Sunday’s crash but are rebounding as the new week begins.

XRP Soared On Filing Of Motion To Dismiss Lawsuit

XRP continued to soar close to $2 amid more positive developments – Ripple executives have filed a motion to dismiss the SEC lawsuit. If the motions are granted, the lawsuit will end. Riding fresh from 2 small wins in the courts, this spurred sentiment on XRP to an ATH, with the token surging on huge volume.

The ATH of $3.30 is clearly in sight, although the token has fallen back around 50% after tripling in value. With the SEC having until 14 May to file their defense to counter Ripple’s request, we may need another month to see if XRP is able to test its ATH.

Other good news surrounding XRP is that CoinShares announced the launch of a new XRP ETP on Europe’s third-largest exchange, the SIX Swiss. CoinShares will similarly launch the same ETP on LTC this month.

DOGE The Star Of The Week As It Moons 500%

The undisputed talk of the town though is DOGE. In usual DOGE fashion, the meme token doubled over 24 hours for 3 days, rising a spectacular 500% in just 3 days after Mark Cuban says his Dallas Mavericks NBA Team have pulled in some 112,000 DOGE in sales after openly supporting the meme coin in March. The key importance here is that the NBA Team will not be selling any DOGE collected, but will instead hodl their DOGE on their balance sheets.

The surge in price to a high of $0.45 (Much WOW) has put DOGE back into the crypto top 10, with a market cap of over $41b and placed at number 5, drawing the irk of many non-fans and crypto experts. Mike Novogratz of Galaxy Digital even issued a grave warning about signs of bubbles forming in altcoins that may not end well.

Charles Hoskinson of Cardano (ADA) even did a youtube video to urge people to get out of DOGE. Despite these calls, the price of DOGE remained strong, holding above $0.30, undeterred by the market crash on Sunday. While not much has been revealed as to why the sudden surge in DOGE’s price, data shows that $12b worth of DOGE tokens had been transferred in just 1 day on Friday. Can this be an original whale selling his stake to new influential buyers?

With Elon Musk, Mark Cuban, and a bunch of celebrities endorsing the mem token, will DOGE be able to continue soaring to greater heights? Many DOGE supporters are hoping that the token will eventually rise to $1.00. While that target has been much laughed at by non-DOGE supporters, it doesn’t look that unachievable now.

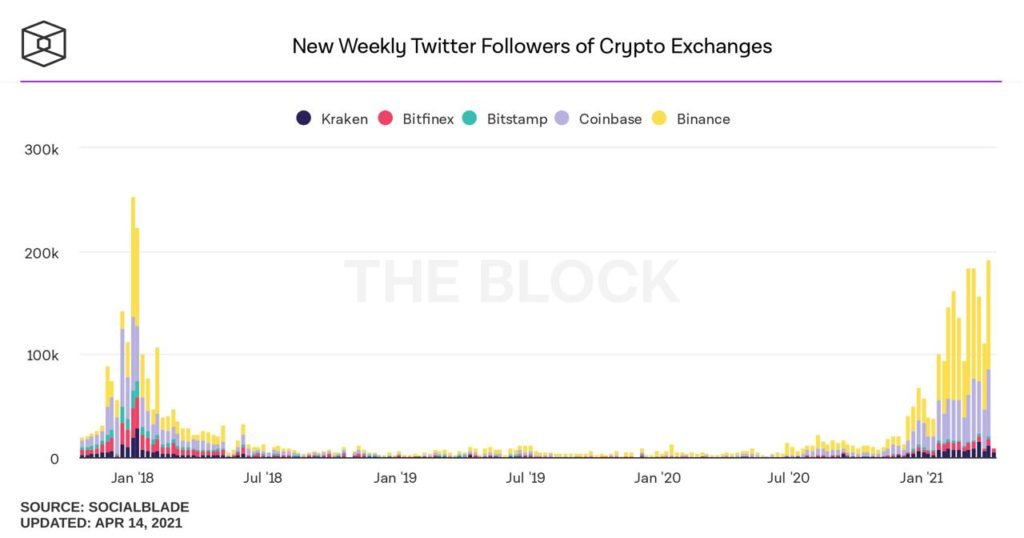

With the altcoin season in full swing, retail traders were moving into the market in droves, as evidenced by the outage experienced by various retail-focused crypto exchanges in the past days. New Twitter followers have spiked significantly since Feb, possibly due to Elon Musk and other crypto experts liking to post market-moving comments on Twitter. This may speak of excessive froth forming in the market with a rush of retail participants coming into the market.

Hence, the Sunday crash is actually a good thing for the market to be able to clear off some excessive froth. The reset is needed for the bull market to be able to sustain a climb to higher levels in the near future. Funding rates are now significantly into the negative territory after the selloff, suggesting that the froth has been taken out and traders are fearful. This counter-indicator often implies that an interim bottom may be in place and prices may start to recover.

About Kim Chua, Noble Trade Hubs Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Trade Hubs. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Trade Hubs recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Trade Hubs. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Trade Hubs recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.