The stocks tanked last week, led by a huge selloff in tech names. China’s announcement of two interest rate cuts didn’t help risky assets even though the Hong Kong stock market did see a bounce on Thursday, while most of the other stock markets were embattled.

The selloff in the European and US markets started early last week and intensified on Friday after disappointing results from Netflix caused tech stocks to crumble. Shares of the streaming giant tumbled by 21.8% on Friday after the company’s Q4 earnings report showed a slowdown in subscriber growth. Investors are now holding their breath for Apple and Tesla reports this week, hoping that they won’t induce yet another blood-letting.

Anxiety over this Wednesday’s FED meeting also caused investors to dump risky assets in advance as most of them expect the FED to show hawkishness. The 10-year Treasury bond yield once hit as high as 1.9% midweek meaning investors are getting increasingly more anxious.

As a result, the Nasdaq posted a 7.6% loss for the week, – worst since October 2020, – and now sits more than 14% below its November record. The Dow lost 4.8%, while the S&P 500 lost 5.2%, with both indices finishing their third straight week of losses and experiencing the worst weeks since 2020.

However Oil continued its fifth week of ascent, hitting a 7-year high of $87 before going down during the last two days of the week due to an unexpected rise in the US crude and fuel inventories. By the end of the week Crude Oil was still at around $84.70.

Surprisingly though, precious metals didn’t seem affected by the stock market rout and rose even higher last week. Gold edged up by 0.8% while Silver rose by 7% despite retreating on Thursday and Friday.

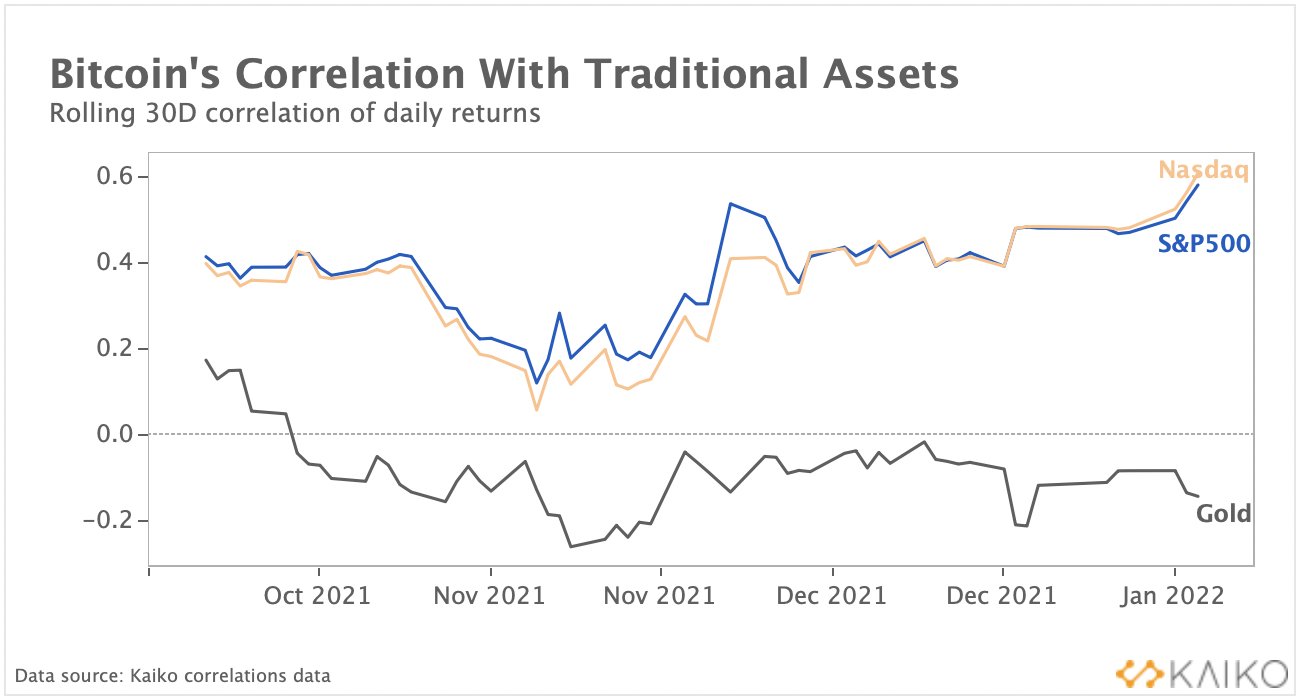

Cryptocurrencies however, did not have the luck of precious metals and went down heavily late in the week due to the rout on the Nasdaq. The tech selloff did not help cryptocurrencies as the correlation between BTC and Nasdaq has been at its highest point since mid-2020.

Series of Bad News Ignited Crypto Selloff

Notwithstanding the contagion from the stock market, Thursday also saw two disappointing news that further affected the crypto market sentiment, causing the BTC price to crash below $40,000 and ETH to cave into the depths below $3,000.

First, the Russian central bank called for a full ban on crypto which would make crypto trading, mining and usage illegal in the country. However, individual ownership of crypto will be allowed. Besides, the US SEC rejected a spot BTC ETF from First Trust and SkyBridge Capital and dragged prices lower, causing cryptocurrencies to crash across the board.

The series of bad news coupled with a large options expiry of around $600 million sent the cryptocurrencies’ prices plunging consecutively on Thursday, Friday and Saturday.

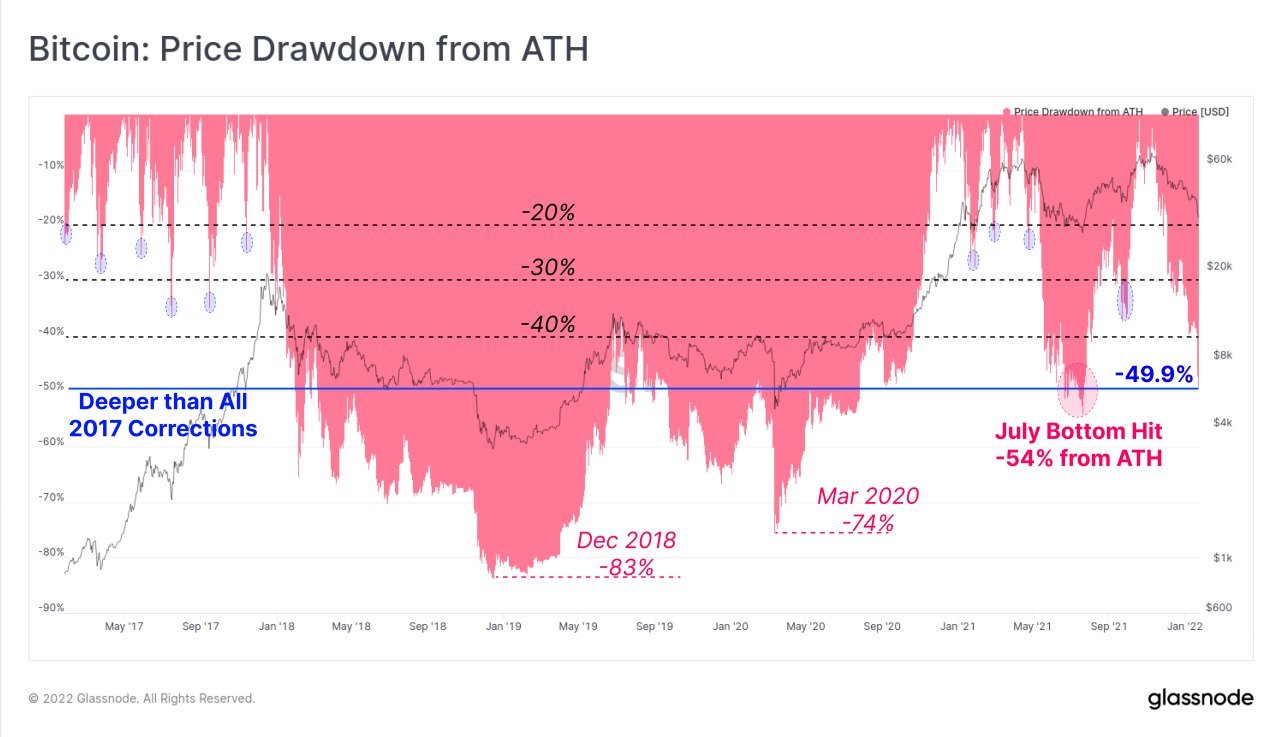

The worst of the crypto selloff happened between Friday and Saturday when BTC lost more than 20% and went from $43,500 to $33,900. As expected, altcoins did a lot worse, with most popular names losing around 25% over the same 24-hour period. The amount of liquidation between Friday and Saturday was more than $1.2 billion, sending the entire crypto market cap falling firmly below $2 trillion when barely 3 months ago it was more than $3.1 trillion. The market has since lost more than $1 trillion of its market cap, while BTC has fallen by 50% from its peak on November 10, 2021. Interesting that the drawdowns since July 2021 have been larger than the drawdowns during the 2017 bull run, yet not as big as the ones in 2018 and 2020 bear market yet. Could this be a sign that the bear market might be beckoning?

While El Salvador used the dip to buy another 410 BTC at an average price of $36,500 per coin, data suggests that the bottom may still go lower.

The Worse May Not Be Over

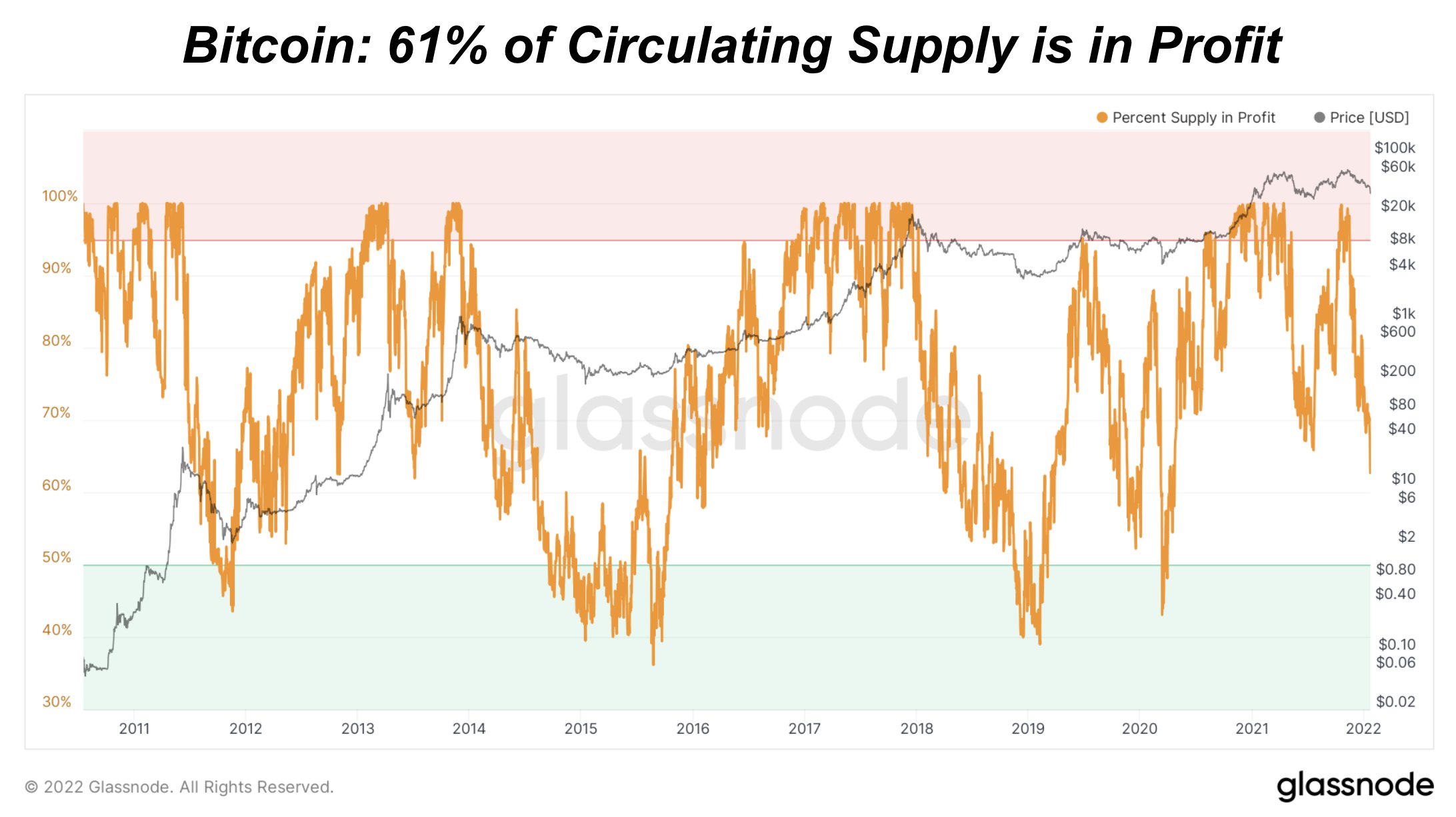

After the latest fall, the amount of BTC supply in profit has fallen to 61%, going down from mid-week’s 71%. While this figure is still higher than when price bottomed after coming off a bear market, there have been instances when price recovered even from this level in 2013 and 2014. The level of around 50% is historically a good area for accumulation.

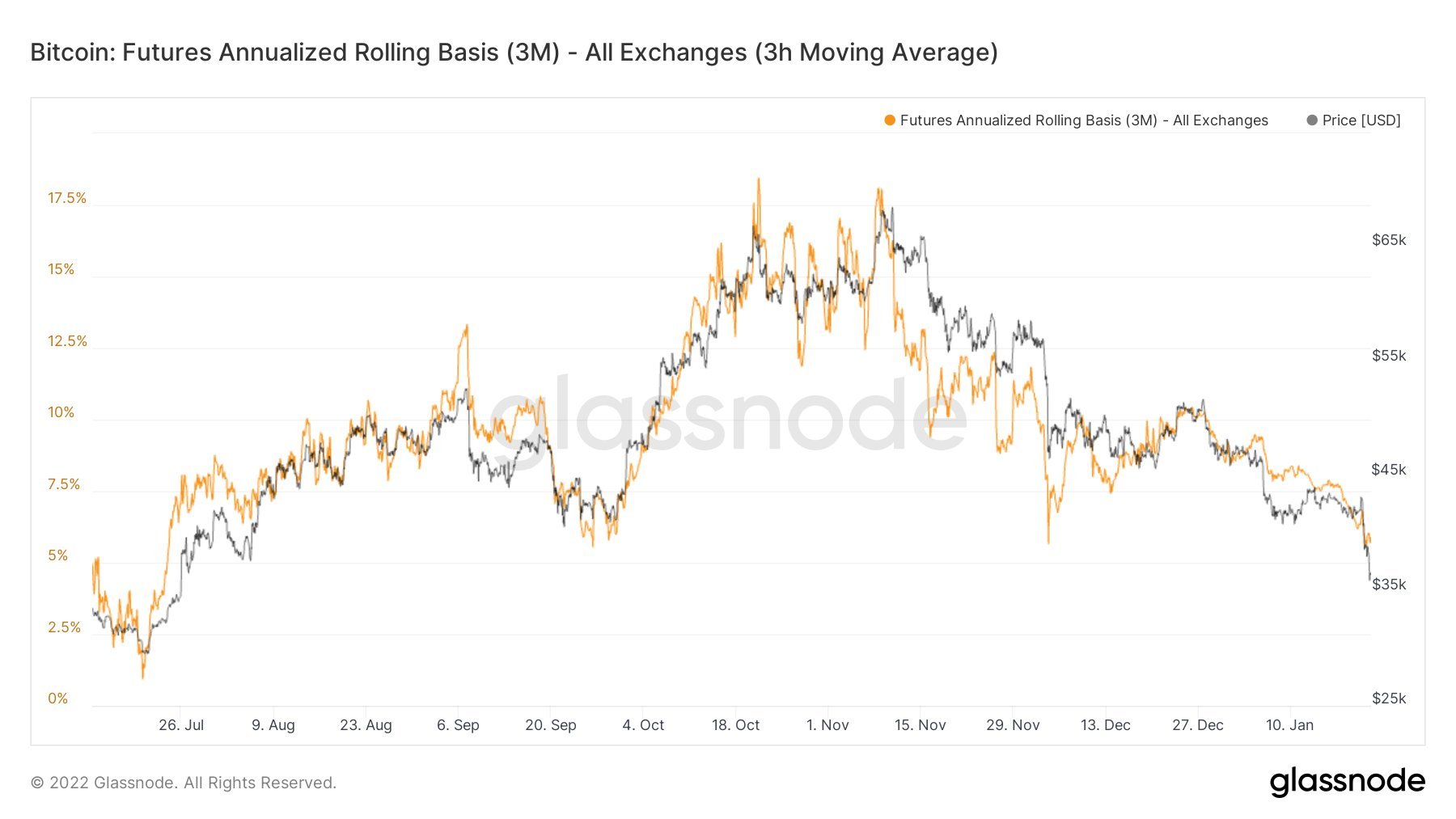

A quick look at BTC futures shows an annualized futures basis of 5.8%. While in October 2021 price rebounded higher after the futures basis hit a similar level, only a basis of zero or negative would mean that all leverage has been wiped out. Hence, this data shows that there is still a bit of froth left in the market.

Altcoins Hard Hit As Price Falls 70% From Peak

After BTC fell 50% from its ATH, altcoins are doing a lot worse, with the most popular names losing between 60-70% from their peak in November. DOGE takes the top loser seat amongst all, having lost around 83% of its value compared to May 2021.

With altcoins falling even deeper than BTC during the latest carnage, the recently developing narrative of altcoins decoupling from BTC during periods of its weakness has been completely thrown out of the window.

With BTC dominance bouncing off a double-bottom on 17 January, it has the potential to outperform altcoins in the coming months.

However, altcoins could do better in the future as the BTC dominance may need a short-term consolidation in order to continue marching higher.

After more than $1.5 billion in liquidations over the last 3 days, funding rates have reset and moved into negative territory on Sunday with prices bouncing off the lows. Alternative Layer-1 smart contract platforms which have been outperforming the market lately are leading the rebound, with FTM and LUNA gaining around 20%. BTC and ETH are also regaining some composure. However, this rebound’s potential will depend on how the traditional market, especially the Nasdaq, performs when trading gets underway this week. Traders bear in mind that results of the FED meeting on Wednesday afternoon, as well as Apple and Tesla results, could continue to bring volatility to tech stocks and affect crypto prices.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Trade Hubs. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Trade Hubs recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.