The foreign exchange market, also called forex and even FX for short, is the world’s most liquid and highly traded market in the world.

The market solely trades currencies that represent a national economy, and determines the exchange rate for the currencies traded there.

It has the highest daily trading volume out of any other market traded globally.

Introduction to the Foreign Exchange Market

Exchanges currencies have always been around, however, the modern currency market began to develop starting in the 1970s after the dollar became unpegged from gold.

USD has always dominated the modern market, through its role as the primary base currency and its global reserve currency status, but later cross currency pairs were developed for more direct currency to currency conversion.

The forex market is extremely popular due to the vast global reach, high liquidity, 24 hour a day trading sessions, and due to the large variety of factors that can influence pricing.

Important factors that can impact forex market fluctuations and asset pricing include political events, pandemics, economic factors and much more.

Forex is also typically characterized by its low relative volatility compared to other markets, therefore smaller profit margins associated with price swings.

Due to this, applying leverage to forex currency trading can yield great results and is commonplace in this market. Leverage can also amplify any losses, so it is critical to understand the risks involved and may not be best for those brand new to trading.

What is Forex Trading?

Forex trading is the exchange of one currency to another currency in the foreign exchange market, aimed at generating a profit from the fluctuations in the price of each currency at the time of the exchange.

Traders can consider a variety of fundamental factors before selecting which assets or trading pairs to take a position in, and perform technical analysis to strategize when and at what price to take the position at.

Once assets or a trading pair is selected, the next step is finding a broker, performing analysis, learning to trade, and developing a plan.

How Does Forex Trading Work?

The majority of foreign currency exchange takes place between banks to other banks, but individual traders can also sign up to a broker or trading platform that offers forex currency trading in some capacity.

Some brokers allow for the direct trading of currencies, while others provide CFDs representing forex currencies. Which option is best for you ultimately comes down to personal preference, but CFDs offer many advantages over holding an underlying asset.

Selecting the right trading platform is vital to profitability, so be certain any forex platforms you consider offer leverage, charting software, risk management tools, and more. Exposure to other markets is also an advantage, so forex positions can be managed alongside stocks, crypto, commodities, and more.

Understanding Currency Pairs

The way forex trading works as you’ve learned, is by exchanging one currency for another as part of a currency trading pair.

All currencies in the forex market are bound to another currency as a trading pair.

The most common base trading pair is USD, due to the currency acting as the global reserve and most dominant currency in the world. It represents the lion’s share of trading volume as a result.

Other “major” currency pairs are commonly available as a base currency pair with other currencies. However, since cross pairs were created, less reliance on USD and other majors has resulted in dozens of other pairs.

Even more exotic pairs have since debuted, which include emerging economies and markets whose currencies are growing in interest, trading volume, and economic power.

Majors: Major Currency Pairs

The four most popularly traded forex currency pairs are considered the “majors” of forex and include:

Crosses: Cross Currency Pairs

Many years ago, if you wanted to exchange, for example, Japanese yen into Canadian Dollars, you would first have to exchange CAD for USD.

At the time, due to post World War II economic strength, most global currencies were quoted against the dollar.

This remains true to this day. Cross currency pairs were created for convenience but since have evolved and flourished into large volume forex markets of their own.

Examples of common cross currency trading pairs include:

Exotics: Exotic Currency Pairs

Exotic forex currency trading pairs typically consist of one major forex currency, and another currency from an emerging market, such as the Turkish Lira or Thai Baht.

Examples of popular exotic forex trading pairs include:

- USD/MXN

- GBP/ZAR

- EUR/HKD

- USD/CNH

Understanding Forex Charts And Technical Analysis

Forex currency trading pair price charts are the same candlesticks or line charts you would analyze trading any other type of asset.

The same technical analysis concepts and methods apply in the forex market as well, as do all of the same oscillators and indicators.

The most important thing to remember, is that the first currency in the pair is the base currency, and the second currency is the quote currency.

Forex charts indicate how many units of the quote currency are necessary to purchase one unit of the base currency.

All currencies use their ISO currency code as their ticker symbol.

What is CFD?

CFD stands for contract for difference, and is an agreement between two parties to settle a contract later at whatever the difference is between the underlying asset price at the time of open and close. Traders generate a profit being on the right side of the bet.

CFD trading is the best way to gain exposure to forex currencies without having to own the underlying asset itself. This also allows traders to get in and out of position a lot faster and more efficiently.

Because CFDs are contracts, leverage can be added as well as long and short positions. And there are often less fees and requirements demanded by a CFD trading platform versus traditional equities brokers.

This type of contract isn’t always available in the United States, however.

Glossary: Forex Trading Basic Terms

Before you consider jumping head first into the shark-filled forex market, there are first several key terms and their definitions that you should familiarize yourself with.

Here is some of the most common and important terminology in forex currency trading:

Leverage

Leverage allows traders to “gear” their trades for greater returns. By putting a portion of capital up for collateral, some trading platforms will then multiply any returns or losses by a factor of the level of leverage selected.

For example, if a trader opens a $100 trade with 100x leverage, the position will have $10,000 in trading power.

Any returns will also be multiplied by a factor of 100 times. However, losses will also be multiplied by the same factor, so there is risk of significant loss if proper risk management strategies aren’t utilized as necessary.

A complete loss of capital or liquidation is possible if one isn’t careful and well prepared.

Margin

Margin is often incorrectly used interchangeably with leverage, but in reality, margin is simply account capital available to be used as leverage.

Enough margin must be deposited to cover the position size and any resulting PnL. If a margin call happens as a result of not keeping enough margin on hand to cover all positions, risk of liquidation is possible. Topping up an account or closing positions may be necessary to avoid such situations.

Traders should always keep sufficient margin in a margin trading account.

Volatility

Volatility is what drives all price movements and therefore profitability in financial markets. Without volatility, assets would trade at stable prices and little money would be made.

Typically, the greater and more explosive the volatility, the more opportunity for profit exists. Various tools exist, such as the Bollinger Bands, to measure an asset’s volatility and it can help tip traders off to when explosive movements may occur.

Pips

Pips are a way to describe a non-specific unit of measurement, expressing the change in value between two currencies. It is most commonly the last decimal place in a currency’s price ticker.

Spread

In forex trading or any trading for that matter, traders are given a bid and an ask price. Bid is the price you can sell an asset at. Ask is the price you can buy an asset at. The difference in price between the two represents the spread.

Lot

In a term that’s highly unique to forex, lots represent a set amount of currency in an order.

The standard lot size is typically 100,000 units of the currency, however, mini, micro, and nano lots exist at smaller currency unit sizes.

Long/Short Trading

CFDs allow for traders to do more than just buy and sell assets. They allow for long and short positions to be taken, so traders can profit from whichever direction the market turns.

In spot trading, traders can only buy low and sell high to profit from price swings. With CFD trading, traders can simply open a long position if they are expecting the price to increase or a short position if they expect the price to fall.

If they are correct, the position can be closed in profit. This lets traders continue to generate profit during drawdowns and allows for advanced trading strategies such as hedge positions.

What Moves The Forex Market?

A near endless amount of factors can impact each nation’s forex currency, then depending on the currency pair, can further create a unique opportunity for trading.

Such factors include everything from political to environmental, to situations like recently with a pandemic causing a major shake up in the strength of many national currencies.

Presidential elections, wars, sanctions, and more also can have a dramatic impact on price fluctuations.

Certain news events and quarterly reporting, jobless claims and more can also influence markets.

How to Start Trading with a Forex Broker

First, you must select a forex broker or trading platform. Ensuing the platform has everything you need and a solid reputation is first and foremost in the to do list.

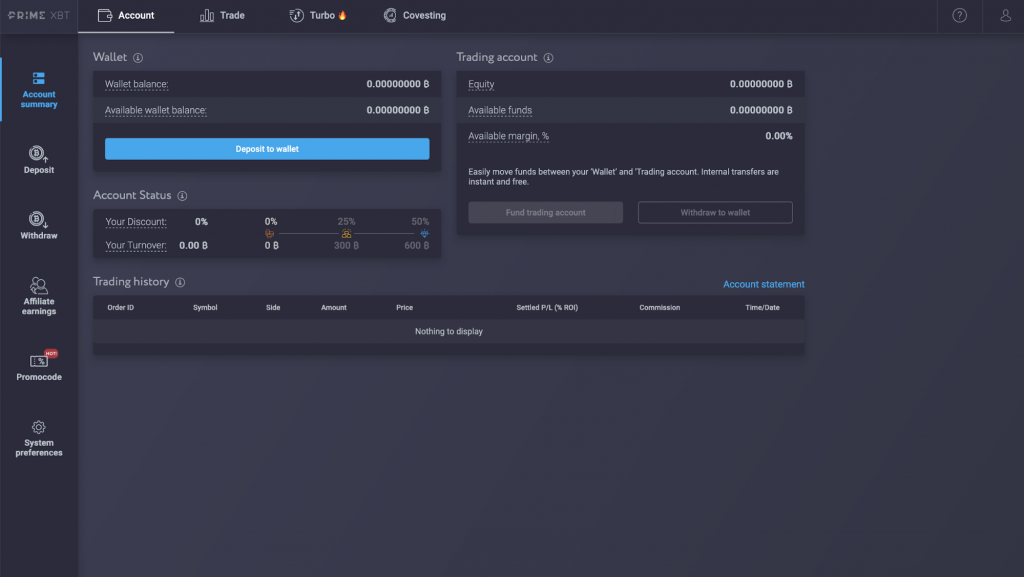

nobletradehub is a reputable, award-winning Bitcoin-based margin trading platform offering CFDs with leverage on forex, stock indices, commodities, and cryptocurrencies like Bitcoin.

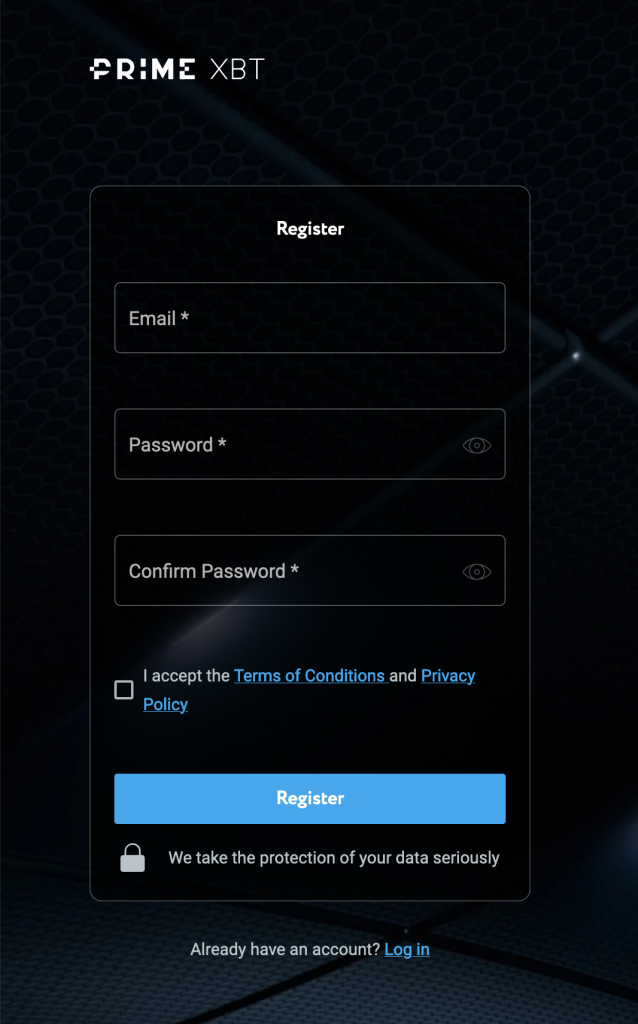

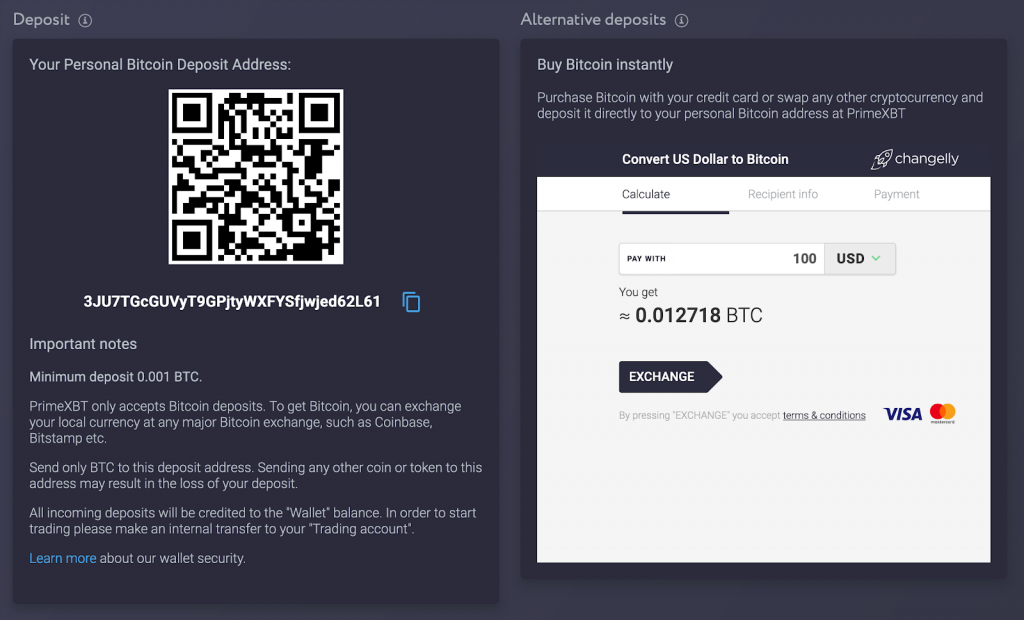

The platform requires a small minimum deposit of 0.001 BTC to get started. Registration takes just 60 seconds or less. It is an ideal platform for both experienced professionals and beginners just starting to learn to trade.

After depositing BTC to a secure Bitcoin wallet protected by compulsory address whitelisting, users can fund their trading account and begin selecting which forex currency pair or other asset to trade.

Conclusion: Find Exciting FX Trading Opportunities With nobletradehub

Now that you have learned the ins and outs of the foreign exchange market – the largest and most traded market in the world – and learned how to get started with a broker like nobletradehub, it’s now time to get started trading.

Using nobletradehub’s built-in charting software, traders can strategize and execute a trading plan right from the platform itself. Clickable charts make for the ultimate in accuracy when taking positions.

Long and short positions are available along with protection orders like stop loss and take profit orders.

Utilizing these critical trading tools can maximize profit and reduce risk associated with high-risk products like leverage.

Using the highly customizable platform is easy for even novices but still offers a powerful punch of trading tools that gets the job done for even the most demanding professional traders.

Register for nobletradehub and start trading forex alongside crypto, stock indices, commodities, and more.

What is Forex?

Forex refers to national currencies traded across the forex market.

What is the Forex Market?

The forex market is the foreign exchange market where currencies are traded globally.

How to Trade Forex Currencies?

Trading forex currencies involves exchanging currencies at different rates in an attempt to generate a profit from the fluctuations in each currency’s exchange rate.

Is It Safe To Do Forex Trading?

Forex trading itself can be extremely safe with some education, careful planning, and sound risk management strategies. It is also important to select a reputable broker that has won awards or received some other industry recognition.

How To Start Forex Trading?

Getting started in the forex market involves selecting a broker and forex currency pairs to trade. nobletradehub is a forex broker offering CFDs on all major currency pairs, plenty of crosses, and several exotic forex currencies. These forex currency pairs are available alongside crypto, stock indices and commodities.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of nobletradehub. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. nobletradehub recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.