Margin trading is the act of borrowing from your broker to increase the position size that you would normally be able to trade. This allows traders to benefit from bigger gains, but also can lead to bigger losses. Margin trading is quite beneficial, but it is also something that should be looked at with caution.

What is Margin trading?

When trading financial instruments, margin is the collateral that a trader needs to put up for deposit with your broker or exchange to cover potential credit risk that the trader poses for the brokerage.

There is a certain amount of credit risk with any type of margin-based trade for the broker. For example, if the traders suddenly found themselves unable to pay, the broker may be left to cover the losses. This is why most brokers, including nobletradehub, have a built-in “negative balance protection” to the platform. This means that they will shut the position down before things get out of hand.

Borrowing a portion of the necessary balance from a broker, the trader can trade a much larger position than would normally be available. The margin used will depend on the market, as different amounts of “leverage” will be available. Leverage is the amount of money that the broker will loan.

Margin Trading Example

As an example of buying on margin, let us say that an investor wishes to buy 200 shares of a company that is currently trading at $60 a share but only has $6,000 in their account. The trader decides to use that cash to pay for half of the position, which is 100 shares. At the same time, they use margin from the account to buy the other 100 shares, borrowing $6,000 from their broker. At this point, the total investment is $12,000.

During the investment, the share price rises 33% to reach $80. This means that the value of the initial $12,000 investment has grown to a value of $15,960. The trader closes the position and then returns the borrowed $6000 to the broker, as well as any minor financing fees. This leaves the trader with $9,960 left. This means they realize a profit of $3,960 on the trade.

If they had not used leverage, the trade would have gained 33% on the original $6,000 – offering a profit of $2,000 instead. However, please keep in mind that a losing trade offers a bigger than normal loss as well. It is because of this that some consider margin trading to be dangerous. In reality, it is only dangerous when used improperly.

If you take the same situation above and see the stock drop from $60 a share to $50 a share, your loss is compound. Your initial value of the position at $12,000 now is worth $9,960 – of which $6,000 needs to be paid back. In that scenario, the trader’s initial $6000 is now $3,360. As you can see, caution is necessary.

What’s the difference between margin trading and short selling?

The active short selling and margin trading are somewhat interconnected, in the sense that you will need to borrow to short a market. As an example, if you choose to short a currency, you need to borrow it to sell it to someone else. If you choose to short a stock, you need to borrow that stock to sell it to somebody else.

Either way, you are hoping to benefit from price depreciation by turning around and buying back the position at a lower level. In that scenario, you are at the very least paying borrowing fees as in the stock market, but more often than not you are also paying some type of margin deposit.

That being said, if you are going long, you can still use margin. In a sense, the two are completely interconnected but not necessarily the same.

How Does Margin Trading Work?

Traders that trade with a margin brokerage sign a contract when they open up an account that allows them to borrow a specific amount of the purchase price of investment. The exact amount does depend on the market involved, as the amount of “leverage”, or the multiplier of your initial deposit will vary.

For example, if you have $1000 cash in your nobletradehub account, you can trade 1000 times that amount, in the currency markets. The idea is that margin trading allows the trader to take on much larger positions than typically allowed. This does not necessarily mean that you need to take on the whole position, but the wise trader will take on a portion of the available leverage.

Margin interest

Like any other loan that you take out, you will have to pay back any of the money that you have borrowed plus interest. The necessary interest varies depending on the amount of the loan, and the brokerage that you are using. It also can sometimes be based upon the asset being traded as well, as the amount of margin will influence this.

The margin for trading has a much smaller amount of interest attached to it than something like a credit card, but it is still something that you need to pay attention to if you are hanging on to a position for longer-term moves. There is no payment schedule, you simply pay the interest as you go along, when you open and close a trade. Typically, the interest is charged at a monthly rate, divided by the time involved.

What Are the Benefits of Margin Trading?

There are a host of benefits when it comes to margin trading, not the least of which would be the ability to trade in much bigger positions than would normally be the case. By putting up a small amount of margin, you can trade as much as 1000 times that deposit depending on the market here at nobletradehub.

Margin trading by extension also gives you the ability to take on more positions than you normally would, because the amount of leverage that you have via a deposit means that you can split up your portfolio into many more positions than without the ability to use leverage.

What Are the Drawbacks of Margin Trading?

While margin trading does offer a significant amount of benefit, the reality is that the using of margin is something that should only be done cautiously, because when you amplify your position, it works both ways. If you are wrong in your training decision, the losses can pile up rather quickly.

Another minor drawback to using margin is the financing costs. While we keep it very small here at nobletradehub, if you are in a position long enough those fees can add up. All things being equal, if you have a robust and profitable system, your financing costs should never threaten your overall profitability. Those who struggle with the financing costs generally haven’t traded well, to begin with.

What Is a Margin Call?

The name “Margin Call” is a throwback to the old days when a stockbroker would call a trader and ask them to deposit more margin in an account. These days, platforms do it automatically, and there is no call involved unless of course, you are a major institution trading in billions of dollars in some type of over-the-counter swap.

If you cannot meet the necessary margin necessary for a position, your broker will start to sell off securities to bring enough free cash back into the account to cover the margin necessary. The calculation for the necessary margin is done in real-time, meaning that it will keep your account from going negative. This is a vast improvement from the traditional broker-client model.

If you do not meet a margin call

If you do not meet a margin call, this triggers an automatic liquidation of your position until there is enough margin left in your account to cover any credit risks. This is done automatically most of the time with brokerages, although some will contact you to suggest that you should put in more margin. At nobletradehub, we protect your account by liquidating whatever is necessary before losses overwhelm you.

Below is a chart that shows how a traditional margin loan would work in a traditional stock brokerage:

| Equity | Equity | |||

| Asset value | Margin loan | $ | % | |

| Buy stock pair for $10,000, half w/ margin | $10,000 | -$5,000 | $5,000 | 50% |

| Stock drops to $6,000 value | $6,000 | -$5,000 | $1,000 | 20% |

| The broker requires 30% | $6,000 | – | $1,800 | 30% |

| Margin call | $800 |

Tips to avoid a margin call

Getting a margin call is one of the more demoralizing things a trader can face. The forced liquidation of the account is very difficult to overcome. Therefore, you must avoid a margin call at all costs. The good news is that it is quite easy to avoid a margin call, with just a bit of caution and common sense.

- Use stop-loss orders: Using a stop-loss order is the most important thing you can do to avoid getting a margin call triggered. By accepting when your trade has not worked out, you can “fight to live another day.”

- Watch position sizing: You need to watch your position size, because going “all in” right away as there is very little in the way of room to let the market move back and forth.

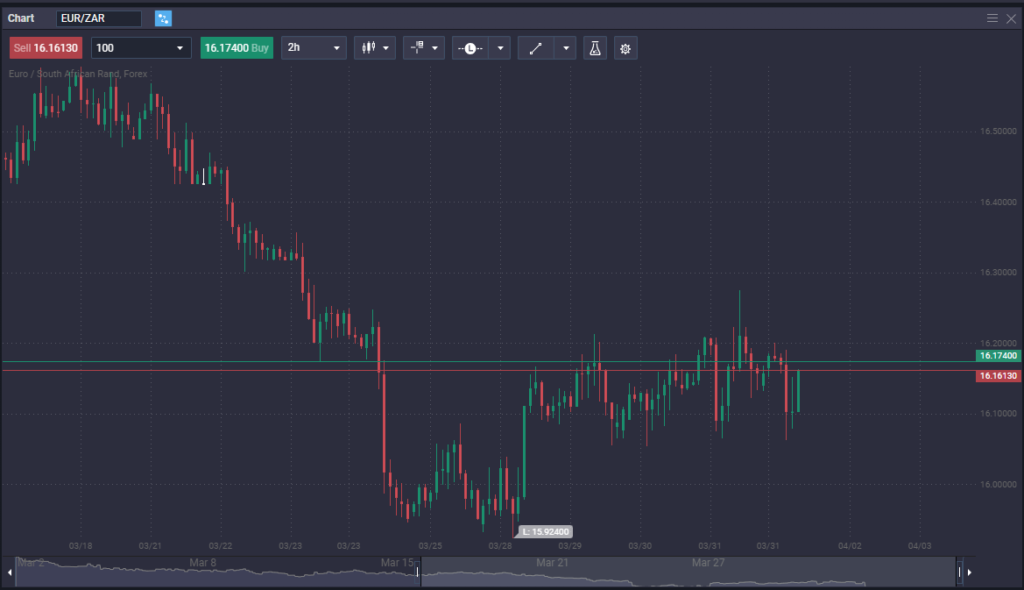

- Trade with the trend: Although some traders are successful in countertrend trading, the reality is that markets do tend to trend for a very long period. By going with the trend and not against that, you increase your odds of success.

- Test your system: Make sure that you have tested your system through historical data to understand whether or not it is profitable in the long term. Unless it is, you should not use margin on it or even trade it.

- Understand leverage: You must make sure that you understand how leverage works, and its potential advantages and disadvantages. Jumping into leveraged trading is a mistake that can be very costly if not taken with professionalism.

How to buy on margin

Buying on margin involves the borrowing of money from your broker to put a bigger position on. In simple terms, you may wish to buy $100 worth of an asset but only have $10. In that scenario, you could borrow the other $90 from the broker to take control. This is a very simplified example, but it gives the proper idea.

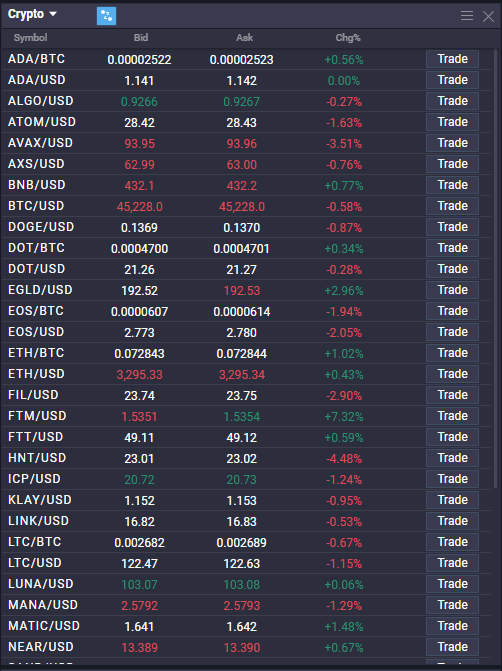

In the real world, you will put up the initial margin, which will vary depending on the market. At nobletradehub, we offer 200 times leverage in the crypto market, 1000 times leverage in the Forex market, up to 500 times in the commodity markets, and 100 times leverage in indices.

The buying of an asset on margin at nobletradehub is done automatically, as all one has to do is put up the necessary margin by pressing “buy” or “sell” on the platform, entering a position. The platform will automatically set aside the specific margin deposit needed and add to it, if necessary, from unused capital.

As long as you have trading capital in the account that is not being used for margin, the platform will automatically “pad your position” along the way in real-time. For example, you may have to put up $500 as margin on a position. If the position drops $100, the platform then moves $100 from your available capital to your margin capital.

When you borrow on margin, there is a bit of interest to pay nightly, so if you hold the position overnight, it is going to cost a small bit of interest that will be calculated automatically. All of this is done without input from the trader.

Conclusion

Margin trading is a great tool if you have a profitable trading system. Furthermore, you need to be very cautious about the amount of margin that you use on any particular trade because it does influence whether your gains or losses get magnified. The more leverage used, the more dangerous or beneficial it can become. The trading of leverage offers a lot of opportunities but is to be used professionally.

When you look at the benefits of margin trading, you should be aware that they can offer significant gains over what would normally be the case, but at the same time, if you are not careful with the amount of margin that you take out, you may find yourself on the losing end of a much bigger than anticipated trade. Understanding how margin works is crucial.

At nobletradehub, we offer negative account protection, meaning that we constantly monitor any positions that threaten both parties involved in the loan to keep disaster at bay. By having negative account protection, you know that you will never owe more than your initial deposit. That being said, you should be very cautious and never get to the point where you have a margin call.

Is margin trading a good idea?

It can be. If used properly, margin can help boost your returns, allowing you to grow your trading account much quicker than you normally would be capable of. However, make sure you understand the damage that misplaced margin trading can cause before you undertake it.

Is margin trading good for beginners?

Margin trading can be used by beginners, as long as they respect the fact that it can also be dangerous. By using minimal margin, it allows traders to “dip their toe into the water” before “going all in.” The ability to risk so little goes a long way toward your education.

Can you make money from margin trading?

Yes, you can make a significant amount of money from margin trading. This is the allure of margin trading, as well as the ability to take on more positions, especially if you are hedging a portfolio.

How long can you hold a margin trade?

You can hold onto a margin trade for as long as you like, with the caveat that overnight financing can be quite substantial over long periods. However, financing costs are more often than not an issue only if something wrong has happened with the trade.

When should you use margin?

You should use margin sparingly, at least until you are comfortable with the concept. That being said, currency traders and others use margin on almost every trade they place. As long as you use caution and a bit of common sense, margin is a great tool.

What happens if you lose a margin trade?

If you lose a margin trade, it is the same as in the other trade, money will be deducted from your account. Keep in mind that margin can magnify losses as well as gains, so this is something that should be thought of ahead of time. This is why money management and using stop losses is a crucial part of trading.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of nobletradehub. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. nobletradehub recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.